Market Update : World Major Stock Market Regression Line

Most of the world stock markets ended lower in the 3rd Quarter of 2022, as concern about rising interest rate ( FED increased the FFR by another 0.75% in Sep and indicated that they going to increase the rate by another 1.25% by the end of 2022), persistently and stubbornly high inflation, increasing geopolitical tensions (blew up of Nord Stream 1&2 pipelines, the annexation of 4 Ukraine territories ), the energy crisis in Europe, the collapse of UK Bond market after the government announced the new tax cut and of course the continuous of struggling economy situations in China ( low PMI, struggling property market, no improvement of economic activities with strict Zero Covid policy ). Commodities prices lost momentum in view of a possible ( or already) world economic recession.

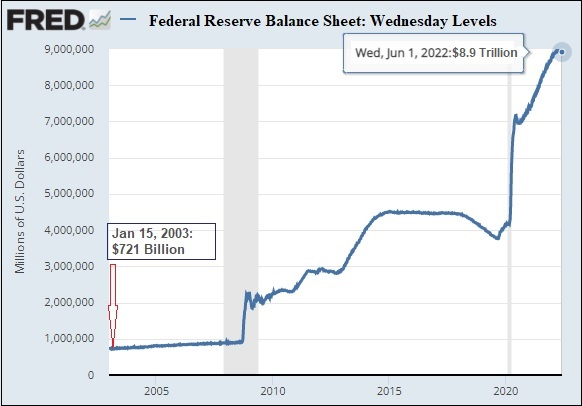

After pumping trillions of dollars of liquidity into the market in the past decades, the world central bank is facing all the above, most unprecedented challenges in recent world economic history, guess this will be much more difficult to tackle as compared to GFC ( Global Financial Crisis ) in 2008/09.

Rising interest rates and QT will affect all asset classes from Equity to Bond, Commodities, Gold, and even Crypto and Cash ( due to inflation).

As mentioned in my previous blog post, due to the above challenges, the market will be very volatile and be ready for a "bumpy" ride. My portfolio value is also up and down like YOYO, was up by almost 11% in early of the year and down to -5%, rebounded to +3%, and again down by -7% now. I am sure your portfolio is also having the same fate unless you are a " gurus or super-investor" who is able to beat the market under the current most challenging environment.

Market Regression Line: Update

Up till 3rd Qtr, STI YTD returns are almost flat at +0.2%, this show pretty strong and resilient price action from major STI components especially 3 Big Banks which still holding pretty well. DBS YTD ( +2.2%), OCBC YTD (+3.8%) , UOB YTD ( +2.8% )

Some of the index components also doing well like, YTD Jardine C&C ( +64%) , Semb Corp Ind ( +54%, Keppel Corp ( +35%) , CDL ( +11.6%).

I guess with a +0.2% YTD return, STI will be able to beat most of the world market indexes this year! and not forget the dividend yield for STI is among the highest in AP :D

The current valuation for STI ( like Banks ) doesn't look "cheap" like during the crisis level.

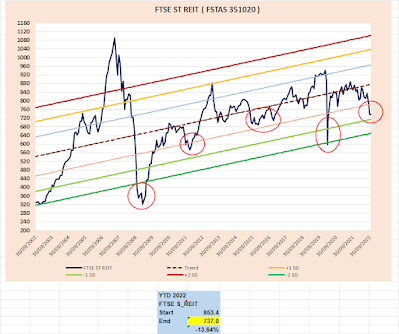

As we know, generally REITs are more sensitive toward interest rate movement as REITs are considered a quite high "leverage product" and have to distribute at least 90% of their taxable income.

Under the current rising interest rate environment, the market would expect a higher yield in line with the increasing Risk-Free Rate together with ERP ( Equity Risk Premium).

Although the overall SG REIT is still not as cheap as, during GFC and Covid-19 pandemic, I think value starts to emerge when some REITs be able to have a 7+% yield. I start to pick up some recently and please DYODD that price may drop further as the market is always "irrational" and unpredictable.

Ultimately, I still believe that REIT could be a good asset class to hedge against inflation in the long run.

The Impact of Rising interest rates on REITs < source:SPGlobal.com>

"Ultimately, whether interest rates are rising or falling does not seem to be the key driver of REIT performance over medium- and long-term periods. Rather, the more important dynamics to address are the underlying factors that drive rates higher. If interest rates are rising due to strength in the underlying economy and inflationary activity, stronger REIT fundamentals may very well outweigh any negative impact caused by rising rates."

With YTD returns of -26.4%, no doubt HSI will be one of the worse performing indexes in the world, maybe only beating NASDAQ which has -32.4%, but we will need to take note that NASDAQ has gone up by +61% from Covid pandemic low whereas HSI still -20.6% lower than Covid-19.

HSI is at 13 year low now and it breaks all the previous lows from the trendline perspective ( below -2SD ), a level never seen for the past 28 years, the index is almost -47% from the last peak achieved in Mar 2018.

But to be fair, as explained before, we will need to take note of the inclusion of more tech stocks into the index over the past few years. This has increased the volatility as China's regulatory starts to crack down on the tech sector after 2018/9. The current trendline may not reflect the long-term valuation correctly, but still,, from an absolute %, your return will definitely look ugly if you invest in the HKG market for the past few years. You will need a "strong heart" or mentality to look at your portfolio value shrink by that magnitude.

I have added some 2800 ( Tracker Fund ) but again, please DYODD as this is going to be a really challenging market, please also ensure your do have a diversified portfolio and do the "position sizing" so as not to be over-exposed to certain markets or sector.

The only catalyst for HSI to turn green is the scrap of Zero Covid policy, without this, no matter how the government try to stimulus the economy, it will not have much impact as the " mobility" still is the key ( like our blood circulation) for all the economic activities.

As for the US market, S&P500 and NASDAQ both corrected more than -20% and fell into bear market territory again after recovering nicely from June after FED increased the rate by another 0.75% in Sep and indicate that the rate shall increase by another 1.25% in the two remaining meeting by year-end of 2022. Both S&P500 and NASDAQ are still 8-10% above the trend line.

Fed's Daly: 'Comfortable' with 4.5%-5% Fed policy rate in 2023 < source: reuters.com>

With more hawkish remarks from FED, the market doesn't expect any rate cut in 2023, and the rate may remain high throughout 2023, depending on inflation figures, and whether the rising rate will be able to tame the inflation.

As highlighted in my previous (above) blog post, the market is adjusting to 1) More realistic PE and 2) Lower EPS.

|

| <data source:currentmarketvaluation.com> |

"The P/E ratio is a classic measure of any security's value, indicating how many years of profits (at the current rate) it takes to recoup an investment in the stock. The current S&P500 10-year P/E Ratio is 26.3. This is 31% above the modern-era market average of 19.6, putting the current P/E 0.8 standard deviations above the modern-era average."

The market is adjusting to a more realistic PE and toward a long-term mean.

As for the 2) EPS, most recent's companies' announcement doesn't look good as some trim their revenue forecast and some miss their earnings forecast. Analysts have also started to revise their earning estimates for coming Quarters and 2023.

2nd Oct 2022: Analysts made the largest cuts to Q3 earnings estimates for $SPX companies during the 3rd quarter in more than 2 years

|

| <data source: factset,com> |

1st Oct 2022: Analysts lowered Q3 earnings estimates for $SPX companies in 10 of 11 sectors during the 3rd quarter, led the Materials sector

|

| <data source: factset.com> |

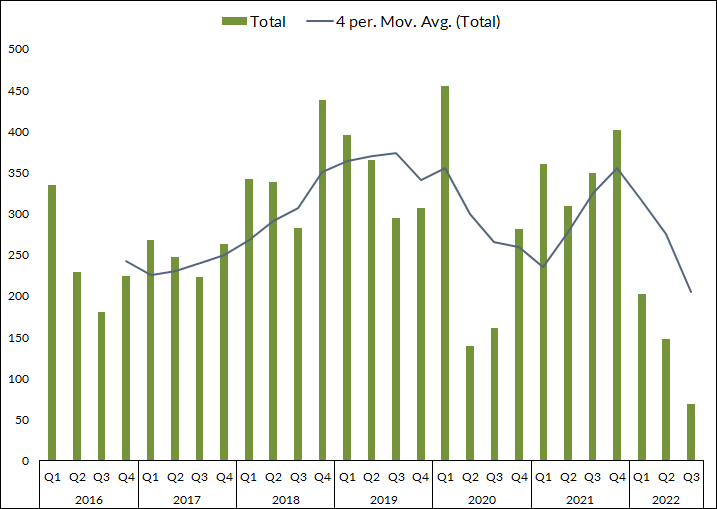

As we know, total shareholder's return includes: 1) Dividend 2) Capital gain 3) Share Buyback

Obviously, share buyback has been in decreasing trend in 2022, and with the new 1% excise tax to be implemented in2023, I am not sure if the share buyback will come back as strong as in 2019 and 2021. |

| <data source:factset.com> |

On August 16, President Biden signed the Inflation Reduction Act (IRA) into law. With its passage comes a new 1% excise tax on corporate net share repurchases. “The buyback tax” aims to penalize companies for engaging in this type of shareholder accretive activity. Like so many pieces of legislation, this tax could spark unintended consequences such as a wave of corporate buyback authorizations and executions this year since the excise tax only applies to the market value of net corporate shares repurchased starting in 2023.

Key Takeaways:

- The Inflation Reduction Act includes a controversial 1% excise tax on share repurchase programs that goes into effect next year

- Corporate event data shows a downtick in total buyback announcements this year after a 2021 surge

- Investors must carefully weigh risks and understand what they own ahead of 2023

The current US market drawdown seems caused by 1) PE adjustment (based on market expectation and sentiment ), 2) EPS adjustment ( lower earning forecast), and 3) Reduction in Share Buyback.

Real QT: Has Not Started Yet !!

As we know, central all over the world had pumped trillions of dollars into the market in the past two years during the pandemic.

Hi Sim. Truly this is the worst of time I have seen since I started in 1990. Do, die, Don't Do, also die. How ah?

ReplyDeleteMy portfolio finally turned RED last week. Lol. Due to HST mainly, else still GREEN. Headache started during weekend. Lol.

Hi Henry, yah..think is quite normal to see "red" portfolio at this point of time.. market is extremely volatile and swing like YoYo...😅😅 Just need to "stay the course" keep calm n collect dividend while waiting for the recovery 😊 Cheers!

ReplyDeleteThank you for sharing your knowledge on Market Update : World Major Stock Market Regression Line. Your blog post was informative and well-explained. I appreciate how you highlighted the benefits of this Stock Market and how it can be used for various purposes. Keep up the great work!

ReplyDelete