A Misconception About Investing Risk and Market Volatility

Volatility ≠ Risk

When it comes to investing, there’s a big misconception

that volatility equals risk. It’s something you hear all the time in the

financial world—news headlines flash with “market volatility,” analysts fret

over fluctuating stock prices. Many investors start to panic the moment

they see red on their portfolios. But for those of us who take a long-term,

value-focused approach, we know that volatility is not something to fear. In

fact, volatility is our friend.

Remember as I always mentioned: Crisis

= Danger + Opportunities

危机 = 危险 + 机会

What Is Volatility, Really?

Volatility is basically how much and how quickly the price

of a stock or asset moves up and down over a given period. It’s typically

measured by the standard deviation of returns—yes, all that maths stuff you

might have learned in finance class. But don’t get too caught up in technical

terms. Volatility just means the price is bouncing around more than usual.

Now, many see this price bouncing as a sign of danger.

After all, who wants to see the value of their investments going on a

rollercoaster? But here’s the thing: unless you’re a short-term trader or

someone who needs their cash tomorrow, you don’t need to stress out about those

price swings.

Why Volatility Is Not Risk

Let’s get one thing clear about risk, in its true form, is

about losing money permanently. You invest $10,000 into a stock, and it drops

to $5,000... and never recovers. That’s risk. You’ve lost that money, and it’s

not coming back, like investing in penny/meme or speculative stocks.

Volatility, on the other hand, is just temporary noise.

It’s the ups and downs that happen daily, weekly, even yearly, but it doesn’t

mean you’ve lost anything unless you sell at a loss. So, for long-term

investors like you and me, who can stomach a bit of turbulence, volatility

doesn’t pose the same threat as it does to someone looking for a quick buck.

In fact, volatility creates opportunities. When everyone is

panicking, prices often get irrationally low. And that’s when we, the smart

money, come in. We buy quality stocks at a discount, knowing that once the

market calms down, their true value will shine through.

Mr. Market and Irrational Moves

This brings me to one of my all-time favourite investment

concepts from the legend Benjamin Graham—Mr. Market. Think of the stock market

as this emotional, erratic guy who offers to buy your shares one day for $100

and the next day for $50, all based on his mood swings.

Mr. Market is unpredictable. Some days he’s super

optimistic, other days he’s in despair. But as investors, we don’t need to

follow his emotional rollercoaster. We just need to recognize when Mr. Market

is giving us a good deal.

Benjamin Graham taught us to focus on the intrinsic value

of a company. This is the real worth of the business, based on its earnings,

assets, and growth potential—not the daily price fluctuations driven by Mr.

Market’s moods. When the market prices a stock way below its intrinsic value,

that’s your opportunity to buy.

And guess when these discounts happen most? That’s

right—during periods of high volatility.

What Warren Buffett and Peter Lynch Think About

Volatility

Take a leaf out of Warren Buffett’s playbook. He’s famous

for saying, “Be fearful when others are greedy, and be greedy when others are

fearful.” That sums up the value investor’s relationship with volatility.

When markets are falling, and everyone is running for the

exits, that’s when you should start looking for bargains. Why? Because during

these volatile times, even great companies with strong fundamentals can get

swept up in panic. The key is to know the value of what you’re buying.

Peter Lynch, another legendary investor, once said, “Far

more money has been lost by investors preparing for corrections or trying to

anticipate corrections than has been lost in corrections themselves.”

Translation: Don’t try to time the market, don’t worry about volatility, just

buy solid companies and hold them long-term.

Both Buffett and Lynch didn’t just tolerate volatility—they used it to

their advantage. They knew that volatility

is a normal part of market cycles. What matters is not the

short-term price movements but the long-term performance of the business.

The Problem with Seeing Volatility as a Risk

Now, why does the financial industry push the idea that

volatility is risk? It largely comes from modern portfolio theory, which ties

risk to volatility. The higher the volatility, the higher the “risk,” or so the

theory goes. This idea gets reinforced by tools like the Sharpe ratio, which

penalizes investments that fluctuate a lot, even if those fluctuations lead to

big gains in the long run.

But here’s the flaw: by focusing so much on volatility,

investors can miss out on the real risks. The real risk isn’t price swings—it’s

buying bad businesses or overpaying for stocks. If you’ve done your homework

and bought a fundamentally strong business at a reasonable price, then

short-term volatility doesn’t matter. The stock will eventually reflect the

company’s true value.

Benjamin Graham’s “Margin of Safety”

Benjamin Graham was a master at reducing real risk, and his

strategy for doing so was simple—use a margin

of safety. The margin of safety is the difference between a

stock’s price and its intrinsic value. The bigger the margin, the

less likely you are to lose money over the long run.

By buying stocks at a deep discount, you protect yourself

from errors in your analysis or unforeseen market conditions. Even if the

market goes south for a while, your investment still has a buffer, reducing the

chances of permanent loss.

This concept aligns perfectly with the idea that volatility

is not risk. If you’ve got that margin of safety, short-term volatility becomes

irrelevant. You’re insulated from the market’s emotional swings.

How We Can Use Volatility to Our Advantage

As value investors, we should be excited about volatility

because it gives us opportunities to buy good companies at cheap prices. Market

corrections, economic downturns, and global events all lead to increased

volatility. But remember, these events don’t destroy strong businesses

overnight. What they do is create a temporary mispricing in the market.

When volatility spikes, most investors react

emotionally. They sell at the bottom and miss out on

future gains. But we do the opposite. We keep a cool head, study the

fundamentals, and take advantage of the dips.

In a way, volatility acts as a tool for us. It shakes out

the weak hands, the speculators, and the short-term thinkers, leaving the true

bargains for those willing to look past the short-term noise.

In Howard

Marks' latest YouTube video, "How

to Think About Risk,"

Howard Marks emphasizes that traditional academic

definitions of risk—such as volatility, standard deviation, or Value at Risk

(VaR)—are flawed in assessing the true nature of risk in the market. He

challenges the conventional academic definitions of risk, according to Marks,

these measures are insufficient in capturing the real essence of risk for

long-term investors. Volatility merely reflects short-term price fluctuations,

which do not accurately represent the risk that matters: the possibility of permanent capital

loss.

Marks believes that real risk comes from the possibility of permanent capital impairment, driven by bad decisions, deteriorating fundamentals of an investment, or paying too much for a stock. He stresses that investors should focus more on understanding the business and its intrinsic value rather than short-term price movements.

He also highlights that risk in the market is often tied to

psychological factors. When market participants become overly optimistic, they

drive up prices to unsustainable levels, increasing the likelihood of future

corrections. On the other hand, when fear dominates, opportunities arise for

savvy investors to buy undervalued assets. For Marks, understanding risk

requires a deep knowledge of market cycles and human behavior, rather than

relying on mathematical models that reduce risk to a set of numbers like

standard deviation.

Marks emphasizes

that true risk arises when an investor permanently loses capital due to poor

investment decisions, deteriorating company fundamentals, or overpaying for an

asset. He dismisses the idea that price volatility should be feared, as it

doesn’t necessarily indicate that the business itself is in trouble. Instead,

volatility can present opportunities to buy quality assets at discounted

prices, as long-term investors should focus on the underlying business, not

day-to-day price swings.

He also delves

into the psychological aspects of risk, explaining that market sentiment often

amplifies risk. When investors become overly optimistic, they drive asset

prices higher, often beyond their intrinsic value, which increases the

potential for future corrections. Conversely, when fear and pessimism dominate

the market, prices tend to fall below intrinsic value, creating opportunities

for astute investors to buy undervalued assets.

Marks argues

that successful investors understand that risk is deeply tied to market cycles

and investor psychology rather than academic models. He encourages investors to

focus on fundamentals and value, rather than being influenced by market noise

and short-term volatility. By doing so, investors can better manage risk and

take advantage of market inefficiencies created by emotional swings, thereby

enhancing their long-term returns.

This is a good

YT to explain the Market or Investing Risk and I hope you enjoy watching it:

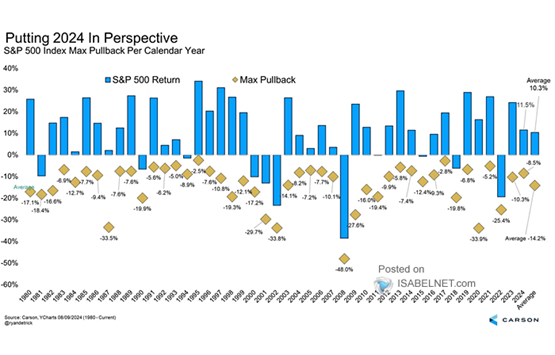

Now, if you look at below “Regression Line “from most of

the stock market, it bounces up and down in the long run. Market drawdowns of

10-20% are common due to natural market cycles, driven by factors like economic

data, interest rate changes, geopolitical events, and investor sentiment. These

swings reflect short-term reactions, not long-term fundamentals, and are a

normal part of the market’s ongoing price discovery process.

|

| <Image credit: Carson.com> |

Market volatility, much like the changing seasons, is a natural part of the investment landscape. Just as winter always gives way to spring, market cycles move through phases of growth, contraction, and recovery. Investors often fear volatility, seeing it as a risk, but history shows that markets tend to revert to the mean over time. This means that extreme highs and lows are temporary, with prices eventually settling around their long-term averages.

In the short term, sentiment and external shocks can drive markets to swing wildly. However, over the long run, fundamentals like earnings, cash flow, and economic growth dictate the true value of assets. Just as no season lasts forever, neither do market booms or busts. By understanding this cyclical nature and focusing on long-term value, investors can weather market storms and benefit from the inevitable "reversion to mean", capturing growth when calm returns.

|

| <Image credit: Zeevyinvesting.com> |

|

| <Image credit :www.Vaneck.com> |

Like the recent Hang Seng Index, it shot up by almost

+36% in just 2 weeks and about +54% from a year low. This is an increase

of about HKD 6 Trillion in market capitalization (wealth effect) in a few weeks.

The stock market sentiment could just swing with the sudden change in policy

direction or narrative about the future of the economic situation. The

change of mood/narrative in the HK market was caused by the announcement

of a slew of new stimulus packages or measures by MOF / PBoC on 24

September 2024, including cutting the interest rate RRR by 50 bps, freeing

up about 1 trillion yuan for new leading. Also, additional measures like the issuance

of more LT bonds to support the property market, providing swap facilities

with new funds for companies to do share buyback (500 billion yuan or more)

and setting up a central support fund to stabilize the capital

market.

This policy announcement has successfully unleashed the “animal

spirit” of investors in the short term, but in the long run, we will

still need to see an improvement in the company's earnings or overall economic

situation

As we know, monetary policy is meant to influence the short-term

capital flow within the system but for long-term economic growth, it will still

need to follow up with a fiscal policy to address or solve the long-term structural

problems in housing and local government debt issue.

As such, the China Ministry of Finance held a press

conference on the 12th of October 2024 where the officials

spoke about defusing local debt risks and stabilizing the property market,

adding the central government “has room” for further action and higher

deficits. A specific figure for fiscal stimulus was not revealed.

7 major takeaways

The finance ministry reiterated the central government still has “room” to raise debt and the fiscal deficit, but didn’t reveal any broad-based stimulus measures markets were hoping for.

The headline policies announced at the ministry’s

conference were as follows:

- Allocate

400 billion yuan (US$56.57 billion) from the local government debt balance

limit to expand local financial resources.

- Tap

funding from an unused bond quota of 2.3 trillion yuan (US$325.3 billion)

for local governments.

- Introduce

a one-time, large-scale debt ceiling increase for local governments to

swap their hidden debts.

- Allow

local governments to use special bonds to purchase idle land from troubled

developers.

- Use

special bonds to purchase existing commercial homes. Earmark more funds for

offering government-subsidized homes, and less on building new homes.

- Optimize

tax policies and study the abolition of value-added tax on ordinary

residential buildings.

- Double

the quota for college student subsidies and increase the per-person

amount.

I am not sure how the market will react to this

announcement but I think we should look at it in a more holistic way that the government

is determined to solve the long-term structural issues like local government

debt and housing issues which I have mentioned before that the housing problem

is the “ mother of all problem”

unless we see the government put in real $$ to solve or at least stabilize

or stop the vicious cycle, it will be tough as the economy growth will be

dampened by this so-called “ balance sheet repair” where peoples are doing the “ de-leveraging”

rather than investment or spending.

As we all know, investing in China or rather the HK

market is very much “policy-driven “where a sudden change in policy direction will have a big

impact on a certain industry in particular or the economy in general,

like the past few years of policy on curbing [property speculative and tech crackdown.

The China Politburo Standing Committee

meeting on September 26, 2023, is significant because it signals a

potential shift in policy direction to address critical issues in

China’s economy, particularly the housing crisis and local government debt.

The

Politburo’s emphasis on stabilizing the housing market could indicate the

government’s readiness to ease restrictions, provide more liquidity to

developers, and encourage homebuying with more favourable policies. This would

mark a shift from the previously stringent "three

red lines" policy, which curbed developer borrowing and

contributed to the sector's financial stress.

Conclusion: Embrace Volatility, Ignore the Noise

Obviously, volatility isn’t something to be feared—it’s something to be used. If you’re investing with a long-term horizon, short-term price movements won’t make or break your portfolio. What matters is buying solid businesses at reasonable prices and holding them as they grow over time.

So, next time the market gets volatile, don’t panic.

Instead, think of it as an opportunity. Look at it the way Warren Buffett,

Peter Lynch, and Benjamin Graham would—volatility isn’t a risk,

it’s a chance to buy great companies on sale. By understanding

this and sticking to a disciplined, value-based strategy, you’ll be

well-positioned to grow your wealth while others get caught up in the market’s

emotional swings.

But again, one must take into consideration his/her “risk

tolerance” in portfolio management, as some markets are typically much

more volatile than others, it is good that you only invest in the market to

the point that you can “stomach the volatility” or “sleep well” in the night.

😊

Till next update!

Cheers …. 😊

STE

With over 20 years of planning and hard work, you have impressive return, well done! For me, I still haven’t found my perfect formula. I’m eager to learn from your blogs, though I know it will take some time to go through them all. If possible, could you share the total investment you made to achieve $160+ in dividends? Thank you!

ReplyDeleteHi DG Daddy, thanks for the comments 🙏 hope you find my blog useful 😊, as for the amount needed/ to be invested to get this dividend, I have replied you on separate comments. Is more on the whole process and your desire risk tolerance. Hope this clarify 🙏

DeleteHi bro. Long time no see.. .was waiting for your good articles. Thanks for this. Keep it coming. 👍

ReplyDeleteThanks Bro, yah..it has been quite some times since our last meetup, should arrange one after I came back from my China Trip..cheers 👌😊

DeleteOK bro. Do contact me when you are back. Safe trip. 😄

Delete