七线谱:四大天王( China Big Four Banks)

|

| image credit to sohu.com.cn |

The "big

four" state-owned

commercial banks are the Bank

of China, the China Construction Bank, the Industrial and Commercial Bank of China, and the Agricultural Bank of China, all of which are also among the largest banks in the world as of 2018.

The big four

also, the world largest in term of total assets base on 2018 S&P Global Market Intelligence report. FYI, DBS rank 71st with a total asset of approx. USD$388 Billion.

<Source: Wikipedia.com>

“In December 2017, the International Monetary Fund published the results

of a stress test, which looked at the performance of China’s banking sector. It

found that 27 out of the 33 Chinese banks it assessed would not meet capital

requirements in the event of a major shock. The six banks that did meet the

requirements included all of China’s big four banks – ICBC, Agricultural Bank

of China, China Construction Bank, and Bank of China.”

Numerous report or analysis on problems faced by Chinese banking,

ranging from bad debts, asset quality, liquidity and capital adequacy.

Bad

loans in China’s banking system mount, rise 3.6 per cent in the second quarter <source:scmp.com>

Chinese

banks have reported an increase in bad debts and a decline in capital adequacy

ratio in the second quarter, as the year-long trade war has hit the country’s

economy hard.

Total non-performing loans in the

mainland’s banking system rose to 2.235 trillion yuan (US$316.6 billion) during

the three months to June, up 78.1 billion yuan, or 3.6 per cent from the first

quarter of this year. The non-performing loan ratio edged up by a marginal 0.01

percentage points to 1.81 per cent during the quarter.

“The bad-debt ratio

increase and decrease in capital adequacy ratio were within market

expectation.”

The rising bad debts come

as China’s sovereign wealth fund last Thursday took over

While the

CBIRC said that the banks’ credit quality remains stable, the data showed that

the lenders have seen their capital ratio fall along with the economy. China’s

gross domestic product grew at 6.2 per cent in the June quarter, the slowest

quarterly growth rate since 1992.

Chinese banks’ core tier 1 capital adequacy ratio – a key measure of a bank’s financial strength – declined to

10.71 per cent at the end of June, down 0.23 percentage points from three

months earlier.

Banks’ liquidity ratio dropped to

55.77 per cent at the end of June, down 1.04 percentage points from the

previous three months.”

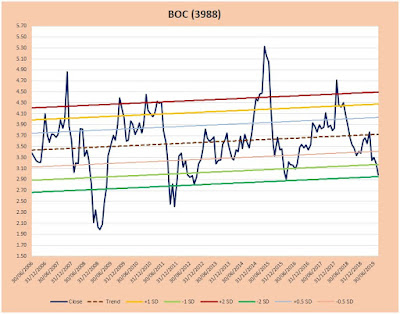

七线谱:四大天王 ( The Big Four )

Because of the escalating trade war and other geopolitical risks, the stock price for these big 4 had plunged more than -35% from early 2018 since the trade

war started.

All Big Four stock price drops to below -1SD and with BOC at

-2SD now, but from the chart, it seems that there will still have room for

further, decrease by 10-20% if it is going to hit the level same as Global Finance

Crisis in 2008/09.

Bank of China

( PE :4.4 / PB :4.5 / ROE : 11.5% / Div Yield: 7.0%/ Tier 1 Cap Ratio:11.6%)

Industrial and Commercial Bank of China

( PE :5.2 / PB :5.1 / ROE : 13.0% / Div Yield: 5.7%/ Tier 1 Cap Ratio:13.2%)

China Construction Bank

( PE :5.1 / PB :5.2 / ROE : 13.4% / Div Yield: 6.0%/ Tier 1 Cap Ratio:14.2%)

Agricultural Bank of China

( PE :4.5 / PB :4.5 / ROE : 12.9% / Div Yield: 6.7%/ Tier 1 Cap Ratio:11.9%)

Since nobody knows how and when the trade may end, and it

might be a “black swan” that causing another global financial turmoil or

economy meltdown.

We will need to be cautious if going to buy into the story of “BIG

Four “, be nimble and take small bites first with position sizing

strategy in mind where you will have room to increase your position if things

turn really ugly eventually.

Cheers!

Quote Of The Day:

“I learned early that

there is nothing new in Wall Street. There can’t be because speculation is as

old as the hills. Whatever happens in the stock market today has happened

before and will happen again. I’ve never forgotten that.” – Jesse Livermore

Comments

Post a Comment