3rd Qtr 2018 : Dividend and Portfolio Update

|

| image credit to Izquotes.com |

YES !! Is time to

calculate and tabulate my dividend & interest income for 3rd Qtr

2018 ( $$$ to be collected in the month of Jul to Sep). I am happy to see some

other bloggers have started to show how much dividend they will be collecting,

it’s really encouraging to see some had seen their dividend amount increased much

on Y.o.Y basis and I’m not sure if this is also kind of “Nudge “ link as what Uncle

CW8888 mentioned that this (by showing our dividend amount from fellow

bloggers) could act as “nudge” for others/readers to save and invest in the

long run.

YES !! as you may notice my investment style, I am more on

dividend income investing, although with mix portfolio of some growth stocks,

again with some dividend. I like getting paid in cold, hard cash and use it

whatever I like. Reinvesting it if I think some stocks are undervalued or keep

it as war-chest if I feel the market is over-valued. The best part is to spend and “buying experience “,

where STE & Mrs. were spending our great time for the 11 days wonderful trip to Iceland. (here

)

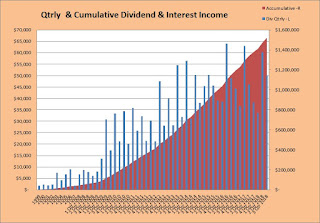

Total Dividend & Interest to be collected in 3rd Qtr = $50,047

I am quite surprised to see that the amount is higher than

last year same period as the 1st & 2nd were both

lower on Y.o.Y basis, I guess this was mainly due to some “special

dividend “ being paid from come counters like banks and Keppel Corp.

Details of Dividend and Portfolio’s update as below :

Total stocks holding increased by 3 to 48 as I divested ST Eng

and bought in another 4, two are new counters whereas the other two are the one

I owned before ( YZJ Shipbuilding and UMS ), where the price has corrected much recently from its high. I have divested these two with quite good profit before (

here- YZJ ) and (

here –UMS ) and hope I could be

right this time around re-collecting these two into my portfolio again.

Top 5

holding remains the same except Lippo Mall has moved one notch up to Nbr

#4, overtaking Comfort Delgro , as I have sold some CDG ( 17.5K units ) to take

some profit off the table and the same time increasing my position in Lippo Mall , Valuetronics (2.5%->

3.3%) and a little bit increased in Global

Inv , Kingsmen Creative as well as Asia

Pay TV. Have also reduced my holding in Design Studio with loss booked, the business still challenging and

I am not so sure if it will recovery by 2019 where I might be wrong on this. I decided to divert my capital to somewhere else for the time being.

Other than Asia Pay TV , which is more on speculative as we

knew that the dividend payout is not sustainable and will be cut eventually,

the rest I intend to hold for medium to long term, depending on the situation.

Anyway, no right or wrong, I will not try to elaborate on what I have bought

as I have always quoted :

"One of the funny things

about the stock market is that every time one person buys, another sells, and

both think they are astute."

- William Feather.

Trade Record: ST Eng

For XIRR of just 5.4% which is slightly higher than

CPF-SA interest rate, with such a result , nothing to be proud of or impressive

at all. Well, obviously, I am wrong in my entry and exit price, by

hindsight. Hahaha..:D

Top 5 Paper loss counters :

Nobody like to look at the loss stocks in their portfolio but

yet in our investment journey, losses in stock investing is very common and will incur anyway. As “loss aversion”

define, the pain is much higher when we look at loss vs winning the same amount of

other counters.Hence, we tend to hold on the loss-making stocks as it’s painful

to “realize “ the losses.

What should I do with all these counters? Divest or

averaging down? Obviously, some may recover and some may not. Can someone

shed some light on it?

Cheers!

Please be reminded that

this is not a call to buy or sell of any stocks mentioned above, as disclaimer, please

DYODD before acting on the information given and all the counters

and the numbers given are just for illustration purposes.

This is earthquake nudge! Lol

ReplyDeleteLOL...:D

DeleteThanks very much for the update- very inspirational to us!

ReplyDeleteI very much appreciate your frankness in admitting and more importantly quantifying your paper losses- not many do that and talk about winners only deluding themselves!

I have similar paper losses mainly with the telecoms and Keppel Corp- I intend to hold on to SingTel and maybe buy more around 3.00-3.05 range. I hold Lippo as well, moderate losses but fortunately small holdings as I am investing in SG only over past 4 years. I plan to buy more at 28-29 cents and take the risk of betting on the emerging Indonesian middle class and their purchasing power!

My opinion on M1- risky punt! Not planning to do anything- down by 30% at least despite dividends!

I am waiting to buy more bank stocks with next pullback, first DBS - will start nibbling away once it is 25 and lower!

Enjoy your midweek break and thanks again !!

Hi darudadri,

DeleteThanks for the advise and insight , yes, Sing Tel will be the better play than M1 as it is more diversify in term of revenue source. As for Lippo Mall , I am betting on their "demographic bonus" as well , I think the urban-city mall still relevant as people need place to gather and of course mall will also need to transform " to sell experience than goods "..as goods can easily be obtained from online e-commerce.

Yessee !! Bank will be the best bet during pullback or even crisis..

Cheers !! :D

Hi STE,

ReplyDeleteThanks for the inspiration from this post. Can you share how do you record your stocks / transactions in your Excel? Am particularly interested in the way you calculate XIRR.

Thanks! :)

Hi v3ng3anc3z,

DeleteThanks for the comments, if you don’t mind to provide me your email , I will forward the excel sheet with some explanation to u separately,,

My email : stesg50@gmail.com

Cheers ! :D

Hi Calvin & Dolce,

ReplyDeleteHave forwarded the sample file to both of u separately.

Hope is in order and useful.

Cheers !

STE

hi

ReplyDeletei noted that u have quite a lot of lippo reit and first reit. both counter constitutes more than 12% of your portfolio, or almost 1/8 of it.

what are your thoughts on the weakening ruppiah affecting these 2 counters in your portfolio? since there is a real possibility of dividend being cut, esp in lippo.. And any dividend cut will affect your overall dividend flow.

appreciate your kind reply.

Hi King Yoland,

DeleteThanks for the comments , yes, indeed , I am also worry about the depreciation of Ruppiah , but for First REIT , since the income is base on SIN $ , the dpu should be fine but for Lippo Mall, yes , is big problem and we may see the dpu dropped further . I am sitting on paper loss of around $27K for Lippo Mall now , but in overall including the dividend , I am still on profit of $61K , at current price , i think the dpu will be around 8+ % if the dpu down by another 10%. I will not make any major adjustment at this moment and see the next qtr's DPU performance.

Hope this clarify.

Cheers ...:)