Portfolio & Dividends Update : 1st Half 2022

Wow ! my last blog post was on 23rd Jan 2022, almost 4 months ago, time flies. I am really lazy to write recently and have been busy lately as my mum passed away last month at the age of 88. It was peaceful, calm, and dignified. My mum was wheelchair-bound for almost 8 years but she was strong and healthy until last year during the lockdown when her conditions deteriorate. Much regret that I was not able to go back during the two years+ lockdowns period and only be able to make contact through video call. Before the lockdown, I try to make a trip back every month to see my mum and also catch up with my siblings. I think most of the elderly (including my mum), don't think you need to buy expensive things for them, just a simple meal will make them very happy ( can see from her smile when I go back and bring her out for dinner every time I go back). What they need are just someone to accompany them and talk to them and a listening ear. I am really glad that I could spend more time with her over the past 6+ years after I stop working in 2015. As you may know ( from my earlier blog post), we came from a poor family, and all my brothers were not even able or had the chance to finish their primary school. It was really tough for my parents (as a construction worker and a rubber tapper) to raise 8 children at that time and that's why my brothers had to stop going to school and help the family by selling "pou" on the street at a very young age. ( by just pulling the bicycle as they are too small to ride it and you know that in those days, the bicycles are much bigger and not as handy as today). As the youngest in the family, I am lucky and blessed that I am the only one in my family that has the chance to complete my tertiary education, and Thank God ! all my siblings are doing ok eventually and some are quite successful in their businesses right now.

To my mother in heaven, thank you for always loving me and guiding me, I love you and miss you every day. 如果真有来生,希望能做妳儿子,再续母子情!

OK, back to the investment issue. I think most of us would experience a "roller coaster " type of swing in our portfolio value as the market has been very volatile since the beginning of the year and till Russia's invasion of Ukraine. My portfolio was up by almost +11% before the war starts and it tanked to -3% after the war and it rebounded slightly to +6.8% now but I think it will continue to be very volatile as the war continues and together with the market's worry about rising FED rate ( possible recession/economy hard landing). As I mentioned before, I am more worried about the QT ( Quantitative Tightening ) than the rising interest rate. The market might be "spooked "by hawkish remarks from FED officers recently in view of " stubbornly " high inflation but I think the increase of 0.5% for the next two meetings is also been priced in, the market may just find an excuse to drop further ( especially for those Tech stocks which has gone up much in the past few years.). My concern will be QT which may lead to less money supply and also deleveraging from Institution Funds where the sell-down of the market may continue.

Because of huge government debts, I think FED may slow down the rate increase after the next 2-3 times 0.5% hike after the FED rate reaches 3%, but the QT of shrinking the FED balance sheet may continue. As we may notice, from the very beginning of FED's denial and said that inflation is a "transitory" phenomenon, FED has no intention to raise the interest rate and they knew that economy is so "addicted " to such a low rate environment, they might find another " excuse " to slow down the increase.

Also, as we all know, the current inflation is due to " supply shock" and not "demand-pull", hence the higher rate may not be so effective to tackle it. But at least the stronger USD may help, also the speculation that Biden's administration is considering removing some of the import tariffs imposed during Trump's Trade War with China, which I think may help to bring down the inflation, to some extent.

As for China, I think the biggest "RISK" right now is the "zero Covid" policy. Some analysts had predicted that the lockdown may cost China’s GDP to reduce by 1-2% point, hence it is really challenging for them to achieve the 5.5% target set earlier. You may notice that so many official announcements on measures to be taken to stabilize the economy and increase jobs creation, but I think whatever policy they announced or measures taken, so long as the "zero Covid" policy remains, it will be hard to have any impact on boosting the economy and lockdown simply doesn't allow mobility or economic activities to be carried out, all the stimulus package is just an empty talk.

The world is facing the 4D challenge ( not the 4D numbers we try our luck every week :) )

Deglobalization: As the US continues to target and label China as a major threat in maintaining their world "superpower", we may see countries being forced to "choose sides" and even at companies level like TSM, which is strategically important in maintaining countries' competitive edge by forcing them to set up plants at the US. Such action may lead to cost increases and a threat to globalization.

US’ chip bid ‘futile,’ Morris Chang says <sources:TaipeiTimes.com>

Deleveraging: As we know, the FED is going to carry out the QT soon and with less money supply and increasing bond yield, companies may be forced to do the deleveraging action like FED to shrink or reduce their debt level which was excessively high due to cheap money or extremely low borrowing cost. With more than double the size of FED's balance sheet now ( approx USD 8.94 Trillion) as compared to the previous QE level of ( USD 4.17 Trillion ), is really challenging to see how FED is going to tackle this and do the "QT" without much impact to the market.

Decoupling: We are seeing more and more decoupling actions from these two world superpowers from economic ( China-US listing ADR issues ) to technology fronts (GPS). The world will no longer be any more peaceful when these two superpowers continue to fight for dominance and the US tries to maintain and keep its No 1 superpower status.

De-dollarization :

"In recent years, with the increased weaponization of the dollar and the use of sanctions, many countries became more incentivized to explore trading in national currencies and using international payment systems other than SWIFT, which is heavily influenced by the U.S. The calls to trade in national currencies have grown even more recently in the aftermath of the largest ever western U.S.-led sanctions on Russia after it launched a “military operation” in Ukraine “to prevent it from joining NATO.”

The sanctions alarmed more countries to the risks associated with relying only on the USD as the international trade currency and promoted the need to encourage trade in national currencies that are not influenced by the U.S. government and financial institutions.

This global trend has extended to the Middle East region. Many efforts, led by Iran and Turkey, were made in the past few years to discover and promote trade in national currencies. Thus far, bilateral trade among Middle Eastern countries increased but remains limited. However, Iranian and Turkish leaders have increasingly voiced their willingness to boost such trading."

De-Dollarizing Trade: How the Global Trade Finance Gets More Nationalized <source:politicstoday.org>

Portfolio Update :

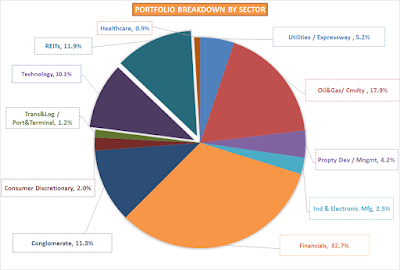

From the above risk factors, we may see many uncertainties and the market will continue to be very volatile. Hence, it is important to ensure that we have a diversified portfolio across different sectors and countries to at least mitigate some of the risk and volatility.

During the crisis, we may see that even an index would drop by more than 30-40%, and is become quite common over the past 15 years when the market has gone through the GFC / European Debt Crisis/ US-China Trade War/ Covid-19 and now Russia-Ukraine War plus possible stagflation.

Even Index investing is not as easy as it seems when we see our portfolio down by 20-30% by investing in index-only ETF. We need to recognize that past performance may not necessarily lead to future performance, this applies to all indexes as we have seen the correction of the HK Tech Index (3067) by almost -63% from the ATH. Imagine if you have just invested in 1 Index i.e HK Tech without diversification, can you stand or stomach such volatility risk and big "drawdown "?

The same applies to S&P 500 or NASDAQ, the last few years of superb performance may not necessarily warrant the good returns in coming years, but if you do understand the concept of the market's peaks & troughs and the markets always move in cycles, holding for a much longer period with continuous DCA regardless of market conditions, you may do fine in the long run. Here we are talking about 20-30 years of the long-term investing horizon, where we always talk about long-term index returns of 10-12% p.a / CAGR. The problem is for those new investors that "jump-ship" halfway and can't stand for the correction of 20-30% along the way.

STE Portfolio YTD Returns : 6.8% ( outperform STI by 1.96%)

My portfolio also outperform FTSE-S REIT by 9.3% and HK HSI by 21.5%

Compare to most of the world stock indexes, STI is the few which are still in positive territory. As we know that STI components are mostly old economy stocks like banks / REITs /property development and some transportation & logistics. This has also "spared" it from entering a correction level (like S&P500) or bear market (like HSI and NASDAQ).

FTSE S-REIT is down by -2.53% YTD as the overall sentiment for this sector is affected by the increasing interest rate. I think the performance for S-REIT may continue to be challenging for 2022, depending on the pace and magnitude of interest rate hikes by the FED and other central banks.

Hang Seng Index is definitely one of the worst indexes with a YTD return of -15.5% ( -32% from the recent high in May 2021 ). You may notice that HSI was trending at below -2SD in Mar 2022, a level never seen in the past 30 years. But we have to take note that HSI is no longer the same as the previous before more and more China Tech stocks joined the index in 2020 ( e.g Alibaba/ Xiomi / Meituan ), 2021 (JD.com / NetEase). As of now, the total tech sectors contributed about 28% of the Hang Seng Index weightage and obviously, the dropped in the HS Index is partly due to the poor performance of these tech stocks.

Although we have seen some changes of "tune" on the so-called "tech crackdown" from policymakers, I am still skeptical and not so optimistic about the future of these tech counters. Also, the direction of the current "zero Covid policy" will be the key thing to look out for and will determine the direction and sentiment as far as future HS index performance is concerned.

No doubt, tech stocks are my worst performing sector with -31% (overall) and -16.2 %YTD in my portfolio. I don't really add any HK tech stocks in the last 2 quarters but will just sit tight and keep it for time being, patiently waiting for its recovery (hopefully if any in the future ..hahaha, maybe just my dream. ).

Basically, not many changes in my portfolio except I have increased my Oil&Gas/ Commodities by a few % points from 13.8% in the previous update to now at 17.9%. I have added more CNOOC and two steel counters ( Baoshan Steel / Maanshan Iron&Steel/China BlueChem) and also basic materials ( Anhui Conch Cement/Asia Cement), two small-cap pharma counters ( ConSun and ShineWay Pharma)

Oil&Gas / Commodities definitely is the sector that came to my rescue this year with YTD returns of +21.5% and cushions of my negative returns in tech sectors.

As mentioned earlier, overall REIT is not doing well ( -2.6% ) but on the other hand, Finance is doing Ok with +4.5% as well as Conglomerate ( CKH/Keppel Corp/SembCorp Ind) + 8.4%.

I have also picked up some US tech stocks recently (a small amount, just trying to test the market and may add more if prices continue to drop). Is really challenging to buy US tech stocks now as the market is going to be very volatile due to interest rate hikes, even though some of them have already dropped by more than 30%. I am also thinking to add some chip counters like TSM /NVIDIA or AMD if Mr. Market gives me chance to collect more and diversify from CHN Techs.

I am still positive in overall tech sectors in the long run although now the tide may go against them. For time being, I will just split my war chest between tech and dividend stocks whenever any opportunity arises.

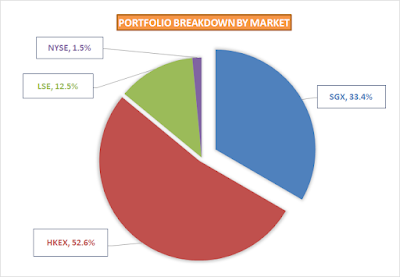

HKEX remains the biggest market exposure for me and followed by SGX and LSE. I just started to pick up some US tech stocks recently with only 1.5% exposure now.

Top 30 Holdings :

** ESR moved up to the top 30 due to the merger with ARA-Logos and now became ESR-Logos.

31-67 Holdings

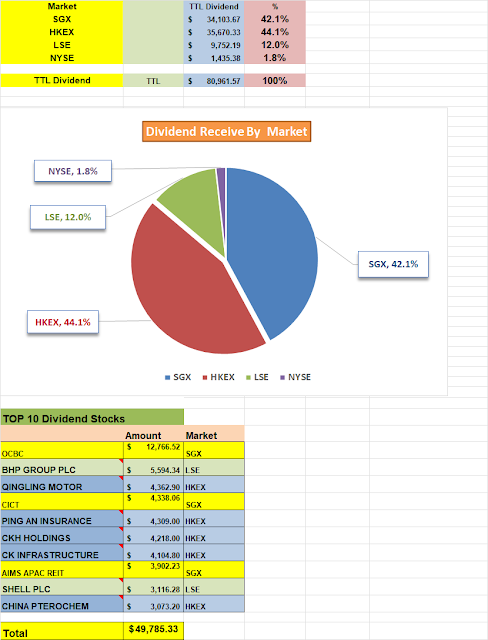

Total Dividend Collected in 1st Half 2022 :

2021 BHP dividend payout was a surprise for me as it increased by almost 2.5x as compared to 2020 and for 1st Qtr 2022, the payout also increased by 50% vs the same period 2021.

Compared to BHP, oil majors like SHELL and BP don't really increase their dividend payout although their profit also increased quite a lot in view of higher oil prices. The board had decided to increase the share buyback, which is also contributing to total shareholders returns by reducing the outstanding share and increasing the EPS.

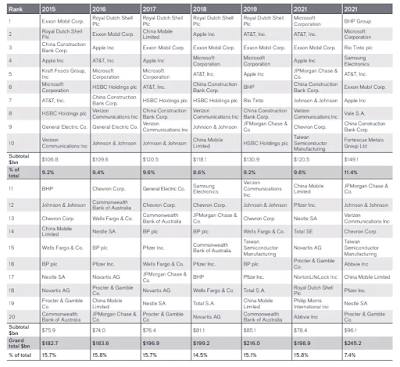

Global dividends hit record high of $1.47tn in 2021 < source:yahoo.finance.com>

Why Time in the Market is More Important Than Perfect Timing

Moving forward, with so many uncertainties still around and affecting the stock market,e.g Russia -Ukraine War / FED QT and Interest Rate Hikes/ China Zero Covid Policy, I am sure the market will continue to be volatile. Nobody can really predict the market direction and I don't have the crystal ball to do that either. Also, I don't think is wise to go for 100% in cash under the current high inflation environment and try to predict the bottom of the stock market which I think is almost impossible.

For me, I will just sit tight, stay the course, keep calm, and collect dividends. Make sure you have a diversified portfolio and also keep your powder dry and have some war chest ready to take advantage of Mr. Market's mood swing.

Cheers !! Till next update.

STE

P.S :

Another Bloodshed and Big Swing for US Stock Market on 10th May 2022:

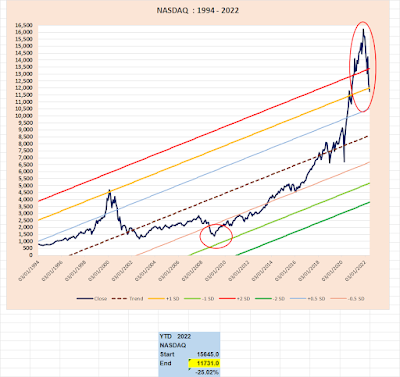

As of writing, US stock market NASDAQ drop by more than 2-.5% and down by -5.36% for the past 5 days. It has entered a bear market territory since it dropped by more than -25% YTD and -28% from 52 weeks ATH.

But if you look at the chart, think is quite normal for the market to revert to the mean after a massive increase over the past two years ( with the help of cheap money and QE ) and the market should expect (or be due for ) such correction when the price had gone up by more than 150% in past two years. I think another 10-20% drop would be possible by judging from the long-term price trend, although one may argue that the earnings for these companies also increase much.

Regression to Trend: 151% Above Trend in April < source : advisorperspectives.com>

About the only certainty in the stock market is that, over the long haul, overperformance turns into underperformance and vice versa. Is there a pattern to this movement? Let's apply some simple regression analysis (see footnote below) to the question.

Below is a chart of the S&P Composite stretching back to 1871 based on the real (inflation-adjusted) monthly average of daily closes. We're using a semi-log scale to equalize vertical distances for the same percentage change regardless of the index price range.

The regression trendline drawn through the data clarifies the secular pattern of variance from the trend — those multi-year periods when the market trades above and below trend. That regression slope, incidentally, represents an annualized growth rate of 1.90%.

Sincere condolences Uncle STE on your mother's passing. Have always enjoyed reading your updates and was wondering why you stopped blogging for some time. Please take care. Family is always most important.

ReplyDeleteHi klsr98,

DeleteThanks for the condolences and warm words. Much appreciated! Yah ... spending more time with family is more important than just accumulating more wealth...you too, please take care and wishing you a Huat year in 2022! Cheers.

Deepest condolences, STE. Actually i have been looking through this site for an update regularly and wondering why you have been absent from writing for such a long time. I hope all's well at ypur end, and I look forward to more frequent sharing of your financial wisdom with your readers :)

ReplyDeleteHi Nigel,

DeleteThanks for the condolences and kind words.Much appreciated! Market seems very volatile .. hope you are being affected by recent tech stocks correction...Yup.. hope I will not be that lazy and find more time to write 😊

Tien Eng,

ReplyDeleteMy deepest condolences on the passing of your dear mother. Your few words in Chinese say it all, you are truly a 孝子.

On the economic front, I share your thought on the 4 D challenges. To these, I may add one more - a war in the Taiwan Straits. In a casual conversation with a senior Western executive some 10 years ago on the growing Chinese economic might , he remarked that the West would not surrender without a fight. Didn't give serious thought then, but development since had showed that this was not a casual remark after all. Had since read about the Wolfowitz Doctrine which surfaced after the fall of the Soviet Union (policy aim is to prevent the re-emergence of a new rival to US). The 2 century old Monroe Doctrine is still very much alive, and has extended in coverage. The Ukraine war is a clear illustration of the doctrine in practice. Worse, the views of political strategists such as Graham Allison (author of "Destined for War") and Elbridge Colby ("The strategy of Denial - a desirable war in the Taiwan Straits) have become the dominant voice in the US. https://www.youtube.com/watch?v=nEchkn3unl8 Even without a war in the Taiwan Straits, a split world would be less productive economically, supply chain disruption would become permanent & inflation would likely persist longer than any periods since WW2. Just hope that I am just 杞人忧天.

Hi Retiree5559, Thank you for the condolences and kind words which is much appreciated. Fully agree on your analysis n further info on geopolitical risk with regard to Taiwan Straits. Yes, this most important"wild card" to be used by US to use as tool to contain the rise of China by creating more uncertainty and chaos around this region.Politics is the most dirtiest game...can see what happens in Europe now... capital flight, weaker EURO, oil dependency on US, huge budget spending on military equipment etc...Yes, the world should condemn Russia for this invasion and pitty Ukrainian for lost of life and families in this war. But we definitely no need to have another NATO types of alliance in this region. But I am sure some countries may think otherwise and continue to push for that (even countries within AP). Nowadays,Ian not sue if politics is creating stability or more chaotic to the world. Food for thought 🤔

Deletehttps://ari.nus.edu.sg/app-essay-kishore-mahbubani-2/

ReplyDeleteAsia, say no to Nato: The Pacific has no need of the destructive militaristic culture of the Atlantic alliance.

Beansprout is ranked as a top Investment Blog Singapore for Investors. Through our blog, we educate Singaporeans about investments and personal finance. You can improve your financial knowledge by visiting this site.

ReplyDelete