President Trump : Make America ( STI Index ) Great Again !

|

| image credit to sginvestors.io |

Not All Index

Are Created Equal

I think most of us are using Index as bench-marking against our

portfolio’s performance and from time to time, we often hear about buying index

as a kind of passive investment. Some financial advisors are even proposing “DCA”

or dollar-cost averaging for Index with “buy and hold” strategy.

“The average annualized total

return for the S&P 500 index over the past 90 years is 9.8 %.”

Guess this is the most “eye-catching” a phrase that often mentioned in the news which is also the most powerful words

to attract investors pouring billions of dollars into Index ETFs under the so

called a “passive investment” strategy.

But remember that not

all Index are created equal if the index is added with many “toxic stocks”,

such an index will sure underperform than other world indexes.

|

| <source:InvestingNote.com> |

Look at the chart, If

you are a fresh graduate who has invested $10K into STI Index fund 5

years ago, locking it with

“buy and hold “ strategy, guess what, your returns will be quite pathetic with

negative returns of -5.28% (excluding dividend). With dividend added, you

returns may increase to about 2.5%+/- p.a.

If we compared such

returns with 10 Bond yield, it only gave us 0.5%+/- over “Market (Equity) Risk Premium “ on the average for the past 5 years, which I think is very low as to take higher risk

by investing in Equity vs Bond.

What is “Market Risk Premium”? < source : Investopedia.com>

Below are

two very good and well-written articles on investing in STI Index as passive

investment.

3 Reasons Why Singapore’s STI

(‘Super Terrible Index’) is a Bad Passive Investment Strategy <source:singsaver.com.sg>

Obviously,

the Banks (with much higher weightage due to larger market cap ) and REITs in

STI Index which performed well in the past few years had assisted to deter the

index from ending up at a much lower level as of today.

Index

investing is about diversification and of course is good to have an index which diversify

across different industries and stocks in order to manage risk ( unsystematic

risk) and reduce volatility.

The Big 3

Banks (especially DBS) which contributed almost 38% (DBS-15.9% / OCBC-11.3%,

UOB-10.6%) of market cap weightage is holding the index well due to good

performance and strong recovery from GFC, else, just look at how badly the

other stocks listed in STI Index perform from the below charts.

It’s not

surprising that so many people like the idea of “passive investing” in Index as

you can imagine that having a portfolio that making money for you while you are

sleeping, “ buy and hold” without much worry about market volatility and keep

it for long term.

Well, 5

years may be too short to see the result as we invest for the long term, how about stretch

our investment horizon to a much longer period?

We will also

need to take note that past 30 years and next 30 years returns will be much

different as Singapore’s economic structure had changed, we experienced

high GDP growth in early 70/80s, but look at the economy growth for the past 5

years is rather low or stagnant. Diminishing returns for STI will continue in

line with GDP growth unless we include more company with international exposure

into STI Index.

With current

STI skewed towards Big 3 banks with as much as 38% weightage, imagine if banks stock collapse,

do you think others can come to rescue?

This is the predicament of the current STI Index. Maybe we should ask President Trump on how to

"Make STI Index Great Again”!

Cheers!

Check this out !!

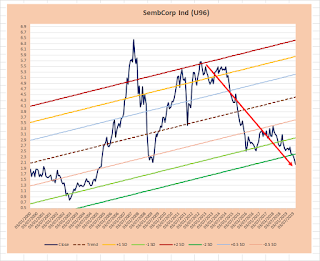

5 years Returns (the period in Red arrow line)

for few selected STI Index Component Stocks.

PS: StarHub

and SIA Eng were both being removed from STI Index in Sep 2018.

Buy, right and hold or else sell and then try again for buy, right and hold. Repeat until you have enough

ReplyDeleteYah, trail and error , only time will tell if we are right or wrong ...that's call "long term" investment ... hahaha :D

DeleteCheers !!

STI Index is not timely managed. Though they have quarterly review, the component change is not fast enough.

ReplyDeleteHi Cory,

DeleteYes , indeed , they may need an " overhaul" rather than juts a periodic review... hahaha.

Cheers ! :D

Hi PL/Yeo/Lee/Chin/Law Et al,

ReplyDeleteThanks for reading my blog and interest of knowing how to plot the "regression chart".

I have forwarded the sample file with some brief explanation ...hope is useful and please do

let me know if you need further clarification.

Cheers ! :D

For those would like to have the file, please do email to below address :

"stesg50@gmail.com"

Please share more like that.

ReplyDeletewill help you more:

City Index review 2019

Thanks for sharing this informative post .I really appreciate it.Investing website

ReplyDeleteIf you are Love Donald Trum Go and support Him to buy Make America again t-shirt Make USA Great Again

ReplyDelete