1st HF 2017 – Net Worth and Portfolio Review

Had seen

many bloggers busy updating their portfolio recently right after the last day of

June, allow me to come and join the party.

Thank GOD,

there was no market crash in 1st HF of 2017 and in fact, STI has

outperformed many regional peers with returned of close to 13% YTD ( excluding

Dividend Yield of around 3-3.5 % which is also one of the highest among Asian

bourses ).

My New Worth

( Including Dividend & Interest received ) increased by 16.7 % which I

think is quite in line with the market ( STI + Dividend return ) but If I have added

in the CPF outstanding, my net worth will drop to only +14% as CPF’s average interest

was around 3.3 % ( combine of 3 accounts ).

I am really happy

to see such 1st HF result which is in line with the market and we should

not expect this double-digit growth of performance to continue as nobody really

know where the market will be heading in 2nd HF of the year. We may

end up with negative return if there is any major market correction happen in 2nd

half of 2017, but allow me to enjoy and be happy with this so-called “ wealth effect “

for time being …. J

Definition :

“Wealth Effect “ by Investopedia

What is 'The Wealth Effect'

The wealth effect is the

premise that when the value of stock portfolios rises due to escalating stock

prices, investors feel more comfortable and secure about their wealth, causing

them to spend more. For example, economists in 1968 were baffled when a 10% tax

hike failed to slow down consumer

spending. Later this continued

spending was attributed to the wealth effect; while disposable income fell as a result of increased taxes,

wealth rose sharply as the stock market moved

up. Undaunted, consumers continued their spending spree.

BREAKING DOWN 'The Wealth Effect'

The wealth effect helps to power economies during bull markets. Big gains in people's portfolios

can make them feel more secure about their wealth and their spending. However,

the relationship between spending and stock market performance is a

double-edged sword as poor stock prices in bear markets hurt economic confidence.

The wealth effect refers

to the psychological effect of asset value increases, such as those experienced

during a bull market, on spending patterns. The concept focuses on how the

feelings of security, referred to as consumer confidence, bolstered by the

rising value of assets, such as investment portfolios and real estate, lead to

higher levels of spending, correlating with lower levels of saving. These

changes are said to be seen regardless of changes in discretionary income, in

either a positive or negative direction.

The theory can be

applied to both business and personal spending. Suggested increases in hiring

and capital expenses increase as businesses become more secure in a similar

fashion to that observed on the consumer side.

---- End of

Definition -----

Well, I

will not be spending more than usual even with this “wealth effect “ and increasing net worth due to favourable market conditions.

How about

you ? will you be spending more ( in luxury items ) in seeing your portfolio’s value

increased during this bull market?

Cheers !!

Quote Of The Day:

"It’s not your salary that makes you

rich, It’s your spending habits.” By Charles A. Jaffe

" Beware of Lifestyle Inflation "

----

Appendix -----

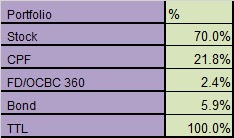

My Portfolio Detail :

Equity Portfolio by Sectors :

Equity Portfolio by counters :

One stock OUT

from my portfolio was HPH Trust and I have blogged about my trade review ( here

) as such, I will not repeat again. As for the IN stock, I have added 3 more stocks

in my portfolio after my last purchased of ComfortDelGro in May.

These ( SPH,

ComfortDelGro, SIN Post ( use to be in STI) ) are the 3 blue chips which among

the favourite of investors and likely to be in your portfolio in view of “investment

moat “ they have, aka of monopolistic business to some extend. All are now

facing their respective challenges due to “digital disruption “ for ( SPH and ComfortDelGro) or business re-engineering

like the case of SING Post.

I am not so sure if these “ fallen angels “

would survive at the end of the day or instead, I am catching the “falling

knife “ and hurt myself eventually. Only time will tell…

At this

point of time, many arguments on the +ve or –ve point of view among analyst,

investors or speculators on these stocks ….and again, I will not justify my

purchase here as I always mentioned and quoted :

"One of the funny things

about the stock market is that every time one person buys, another sells, and

both think they are astute." - William Feather.

Disclaimer :

This is NOT a call to buy or sell any

stocks mentioned above, it is just for illustration purpose, please DYODD ( Do Your Own Due Diligence ) prior to using or acting on any information given.

16.7% is astronomical on Net worth. You truly earn more than you spend idling.

ReplyDeleteHi Cory,

DeleteNet worth increased mostly due to better equity return in thd 1st hf , especially REIT n Finance sector. .also ..partly contributed from my high saving rate of my dividend income received. ..no Lifestyle inflation " of course. ..using public transport. ..staying in HDB and eatting at hawker center ...the key words is " live within your mean"...

:-) Cheers !!