Can we really depend on “Dividend Income “ for Retirement ?

Risks of Living on Dividend Income

“Dividend income” investing has been deep-seated in most of investor’s

mind, as ways to achieve Financial Independence and living off dividends in

retirement is a dream shared by many.

In today’s environment marked by rising

life expectancies, extremely low bond yields, and a 7-year bull market,

retirees face challenges on all fronts to build a consistent income stream that

will last a lifetime. But the questions is “ Can we really depend on

just dividend income for our retirement or is it sustainable ?”.

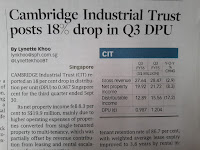

All incomes are subject to risk and the same

apply to dividend pay-out which is not guaranteed. Below two pieces of news

prompted me to write this blog post. One may see that with challenging economic

situation years ahead, reducing dividend pay-out from companies is just a

matter of how much of the cut and not when.

Conglomerate like Keppel and Sembcorp has reduced their dividend pay-out ( hit by oil & gas sector) while Bank is expected to reduce their payout in view of challenging economic facing by China and most of emerging market. REIT and business trust is another sector that showing declining DPU in the recently announced result.

|

| image credit to businesstimes.com.sg/ |

|

| image credit to BusinessTimes.com.sg |

Diversify

your income stream

Retiree or whoever has achieved Financial independence should

realize that depending on one income source will be too risky and a diversified

or multiple sources of income is required during retirement.

If an investor goes all-in on dividend stocks for retirement, he

would be concentrating completely in one asset class and investment style. Poor

diversification of income source will be a disaster during the crisis , one may

look for alternative income such as “ annuities, pension fund ( kind of CPF Life

), Bond, short term money market fund (FD ), SG Bond, etc ..“

A retiree and veteran financial blogger ( Uncle CW8888), clearly and continuously

explain the importance of having “ multiple income taps “ during retirement based

on his own experience.

These two blog links may give you more explanation Link 1 Link

2 about his brilliant concept (tested )!

Otherwise, you may need to also do the “stress test “ on your income

received to reduce the margin of error to ensure that we don’t outlive our retirement

saving & income. How many percents of dividend income reduction is still a "safe level" for you by not affecting your living in retirement?

Concept explained: “Margin

of Error” by Wikipedia

The margin of error is a statistic expressing the amount of random sampling error in a survey's results. It asserts a likelihood (not a certainty)

that the result from a sample is close to the number one would get if the whole population had been

queried.

The likelihood of a result being "within the margin of

error" is itself a probability, commonly 95%, though other values are

sometimes used. The larger the margin of error, the less confidence one should

have that the poll's reported results are close to the true figures; that is,

the figures for the whole population. The margin of error applies whenever a

population is incompletely sampled.

Explanation

The margin of error is usually defined as the "radius"

(or half the width) of a confidence

interval for a particular statistic from a survey. One example is the per cent of people who prefer product A versus product B. When a single, global

margin of error is reported for a survey, it refers to the maximum margin of

error for all reported percentages using the full sample from the survey.

If the statistic is a percentage, this maximum margin of error can be calculated

as the radius of the confidence interval for a reported percentage of 50%.

The margin of error has been described as an

"absolute" quantity, equal to a confidence interval radius for the

statistic. For example, if the true value is 50 percentage points, and the

statistic has a confidence interval radius of 5 percentage points, then we say

the margin of error is 5 percentage points. As another example, if the true

value is 50 people, and the statistic has a confidence interval radius of 5

people, then we might say the margin of error is 5 people.

In some cases, the margin of error is not expressed as an

"absolute" quantity; rather it is expressed as a "relative"

quantity. For example, suppose the true value is 50 people, and the statistic

has a confidence interval radius of 5 people. If we use the

"absolute" definition, the margin of error would be 5 people. If we

use the "relative" definition, then we express this absolute margin

of error as a percent of the true value. So in this case, the absolute margin

of error is 5 people, but the "percent relative" margin of error is

10% (because 5 people are ten per cent of 50 people). Often, however, the

distinction is not explicitly made, yet usually is apparent from the context.

The top portion charts probability density against the actual percentage, showing the relative probability that the actual percentage is realized, based on the

sampled percentage.

In the bottom portion, each line

segment shows the 95% confidence

interval of a sampling (with the margin of error on the left, and unbiased samples on the right). Note the greater the unbiased

samples, the smaller the margin of error.

Having multiple sources of income during retirement is important for all of us as investors plan for retirement.

Below, few

links on how to avoid outliving our retirement fund: for further reading

5 Ways

to Avoid Outliving Your Retirement Savings from Time.com

How to avoid outliving your retirement savings from CNNMoney

Make sure your nest egg doesn't crack from CNBC

Although this

is more on the US’s context and perspective but from the above article most of the

writer promote to have annuities ( aka

of CPF Life ) as a source of retirement income. How about you ? do you have any annuities

from insurance firm as one of the “tap “ of your retirement cash flow.

Cheers!

After 55 and setting aside the CPF full retirement sum, interest earned from the OA and SA will form a vital part of my retirement income. Dividend from stocks will complement the income source. CPF life will form another source from 65 onwards. In the meantime, i shall try to build as large a sum in my CPF SA as possible.

ReplyDeleteHi betta man,

ReplyDeleteGood planing by using CPF to maximize your alternative income flow , yes , dividend income is non guarantee ...we could always treat CPF as annuity ..

Cheers!!

"Can we really depend on “Dividend Income “ for Retirement ?"

ReplyDeleteIt depends.

If one's dividend income is $100K per year, and his expenses is $60K, then he has safety margin of $40K. During the good years, he can re-invest his $40K to build more dividend portfolio.

On the other hand, if one's dividend is $100K per years, and his expense is also $100K, then he may not have enough to cover his expenses if the dividend income fall short during the bad years. In short, no safety margin.

Indeed, having a diversify income stream is better than single source such as dividend. Hence, we could deploy CPFLife, Annuity (Insurance coy), Bond to cater for our basic and regular living expenses. I consider STIETF as stable income instrument as well (3~5% dividend on cost) and not worry any bankruptcy issue.

Hi Ray ,

DeleteYah , your are right , it also very much depend on the " size of your dividend " vs expenses , if the dividend is just 10-20 % of your total expenses , one might be quite safe ,,, even if dividend dropped by half ...as mentioned in the blogs , one may need to do the "stress test " in this regards ... Yes!! thanks for highlighting , STI ETF is also another source of income as it is very diversify and not depending on any particular sector ... :)

Cheers !!

How about part time work or your own little business, isnt that income as well?

ReplyDeleteHi minx my,

DeleteYah! doing some part time work or own little biz is a good idea to have some alternative income source n killed time during retirement. ..:)

Cheers.👍