Portfolio & Dividends Update : 1st Qtr 2023

Wow, it has been almost 4 months since my last blog post/update. I am too lazy to write and spent more time watching " Netflix & YouTube " :D, of course, doing more exercise and reading where we need to always remember that health is wealth. Also important to spend more time with your loved ones where I also went back to MY a few times to attend my niece's wedding dinner and back again for "Qing Ming" the following week.

I know investing could be quite stressful sometimes when the market is volatile and seeing our portfolio value up and down so much. Therefore, spending time with family members is crucial for maintaining healthy and meaningful relationships, especially during times of stress and disorder. Family members can provide a sense of comfort and security during times of stress and can offer emotional support and a listening ear when we need it most, also let us feel less alone and more resilient in the face of adversity!!

Guess you may have the same situation as me that seeing your portfolio value swing like YOYO and up & down like a roller-coaster. Quite a similar situation to last year where my portfolio was up in early Jan /Feb ( by almost +11% ) and down again in March to around +1% and is now up slightly again to around +6.5%.

World Bank warns of 'lost decade' in global growth without bold policy shifts <source:weforum.org>

Average potential global economic growth will slump to a three-decade low of 2.2% per year through 2030, ushering in a "lost decade" for the world's economy, unless policymakers adopt ambitious initiatives to boost labor supply, productivity, and investment, the World Bank warned.

The Path to Growth: Three Priorities for Action <source:IMF.org>

"Of course, we also need a step change in international cooperation to reduce the impact of economic fragmentation and geopolitical tension, especially over Russia’s invasion of Ukraine. This calamity not only kills innocent people; it also worsens the cost-of-living crisis and brings more hunger around the world. It risks wiping out the peace dividend we have enjoyed for the past three decades, adding also to frictions in trade and finance."

With increasing geopolitical tensions and post-pandemic cost increase, The World Bank and IMF have warned that the global economy may lose a decade of economic growth without swift policy action in response to current conflicts between two super-power. This may lead to "de-globalization" which could result in a significant setback in global economic growth and development, a divided world order and standards may also increase the cost of doing business, in all aspects.

China and the US are two of the world's largest economies (super-powers), and their relationship is so important and essential to global economic growth. The ongoing tensions between these countries have resulted in trade disruptions, including tariffs and trade wars, and supply chain disruptions, which can increase the cost of doing business and slow down economic activity. The war between Russia and Ukraine has added so much "uncertainty" and heightened the "vulnerabilities" of the current economic situation.

Global banks are staring at the biggest crisis since 2008 after two US lenders collapsed and Switzerland's Credit Suisse was taken over by UBS. The turmoil has ratcheted up fears of contagion and we are still seeing things unfold and might not be the last bank to collapse.

We continue to see the "deposit flight" from smaller banks to the big banks or even from big banks to money market funds or oversea banks.

Can see from the above chart that FED's balance sheet suddenly increase by a few hundred billion after this bank crisis as banks start to apply or get additional liquidity from FED through the "discount Window " and BTFP.

WHAT IS THE BANK TERM FUNDING PROGRAM?

The Bank Term Funding Program (BTFP) is a lender of last resort facility. It was created in March 2023, after the failures of Silicon Valley Bank and Signature Bank, to lend to other banks that had big unrealized losses on their holdings of government bonds and were, therefore, at risk of large-scale withdrawals of deposits. The facility allows banks to exchange assets such as U.S. Treasuries for cash at their full-face amount, regardless of the current market value. These loans are for up to one year at an interest rate equal to the one-year overnight index swap (OIS) rate, plus 0.10 percentage points. This rate varies daily. As of April 6, the BTFP rate was 4.61%. As of March 29, banks borrowed $79.0 billion through the Bank Term Funding Program, up from $64.4 billion the week before.

WHAT IS THE DISCOUNT WINDOW?

The Fed traditionally exercises its lender-of-last-resort function through the discount window, a permanent facility that lends cash to banks, often for just a few days or weeks. The banks pledge collateral to the Fed but, unlike the BTFP, the Fed will not lend against the full-face value of the bond or loan; instead, it lends up to the market value of the security or loans and, in some cases, takes what’s known as a haircut to make sure the collateral is sufficient to cover the loan. Until recently, the Fed imposed a haircut between 1% and 5% on Treasuries, agency debt (Fannie Mae and Freddie Mac), and mortgage-backed securities, but it eliminated those haircuts after the Silicon Valley Bank collapse. The discount rate, the interest that banks pay on these loans, is set by the Federal Reserve Board. As of April 6, it was 5.0%.

Banks are sometimes reluctant to borrow at the discount window because, if word gets out, it may suggest that the bank is in trouble. Borrowing at the discount window soared from $4.6 billion on March 9 to $152.9 billion on March 15 and fell to $69.7 billion on April 5. The decrease was largely offset by increased borrowing through the Bank Term Funding Program. In addition, as of April 5, the Fed lent $174.6 billion to the banks the FDIC established to take over SVB and Signature Bank.

Some analysts said this might be the revert of QT and returns of QE, but as explained by FED, these temporary measures are not the revert of QT as it's just a "temporary" and short-term policy to inject more liquidity to those banks who are facing the sudden "crunch" in their liquidity.

I actually quite agree with FED's explanation and you may see that the additional liquidity doesn't actually really increase the corporate or consumer credit, in fact, the overall credit is getting tight in the market. The "deposit flight" from smaller banks to bigger banks or money market funds didn't translate into additional credit ( with banks becoming more cautious in their lending after this banking crisis), and more funds actually flow back to RRP.

The Fed sees a looming credit crunch. What's that? <Source: Reuters.com>

Total credit from commercial banks - consisting of their bond holdings and the full scope of loans to businesses and consumers, from routine business credit and commercial real estate loans to residential mortgages and credit cards - is just off its record high from mid-February.

But the credit growth rate has recently fallen below its historic average to a level that has often been associated with a recession. Overall annual credit growth rarely turns negative, but when it decelerates into the low single-digits as it has now, it shows that the lending that helps fuel overall economic growth is under strain.

The credit crunch is here... A survey of 71 banks in the Dallas FED district after SVB's collapsed shows a dramatic reversal in loan volumes.

Why U.S. Stocks May Not Be Worth the Risk <source : morganstanely.com>

Key Takeaways

- In the last month, benchmark U.S. stock indices have given up much of their January gains.

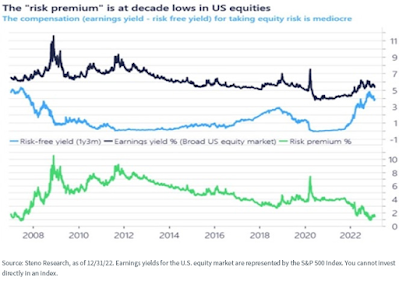

- Still, valuations remain high, and the equity risk premium is at a 20-year low.

- In this environment, investors should seek out yield- and income-generating assets.

|

| <image credit: Wisdomtree.com> |

"Despite recessionary fears and an uncertain path for monetary policy, investors have embraced equity risk to begin 2023. Some measures of the equity risk premium, or the additional return compensation investors require to hold risky assets (like equities), are now hovering around lows last observed during the middle of the global financial crisis in 2008.

Steno Research recently framed the equity risk premium by analyzing the spread between the earnings yield for the U.S. equity market and those available on U.S. Treasury securities. The Federal Reserve’s rate hike campaign over the past year has trimmed this spread to below 2%."

Setting More Realistic Investment Return Targets

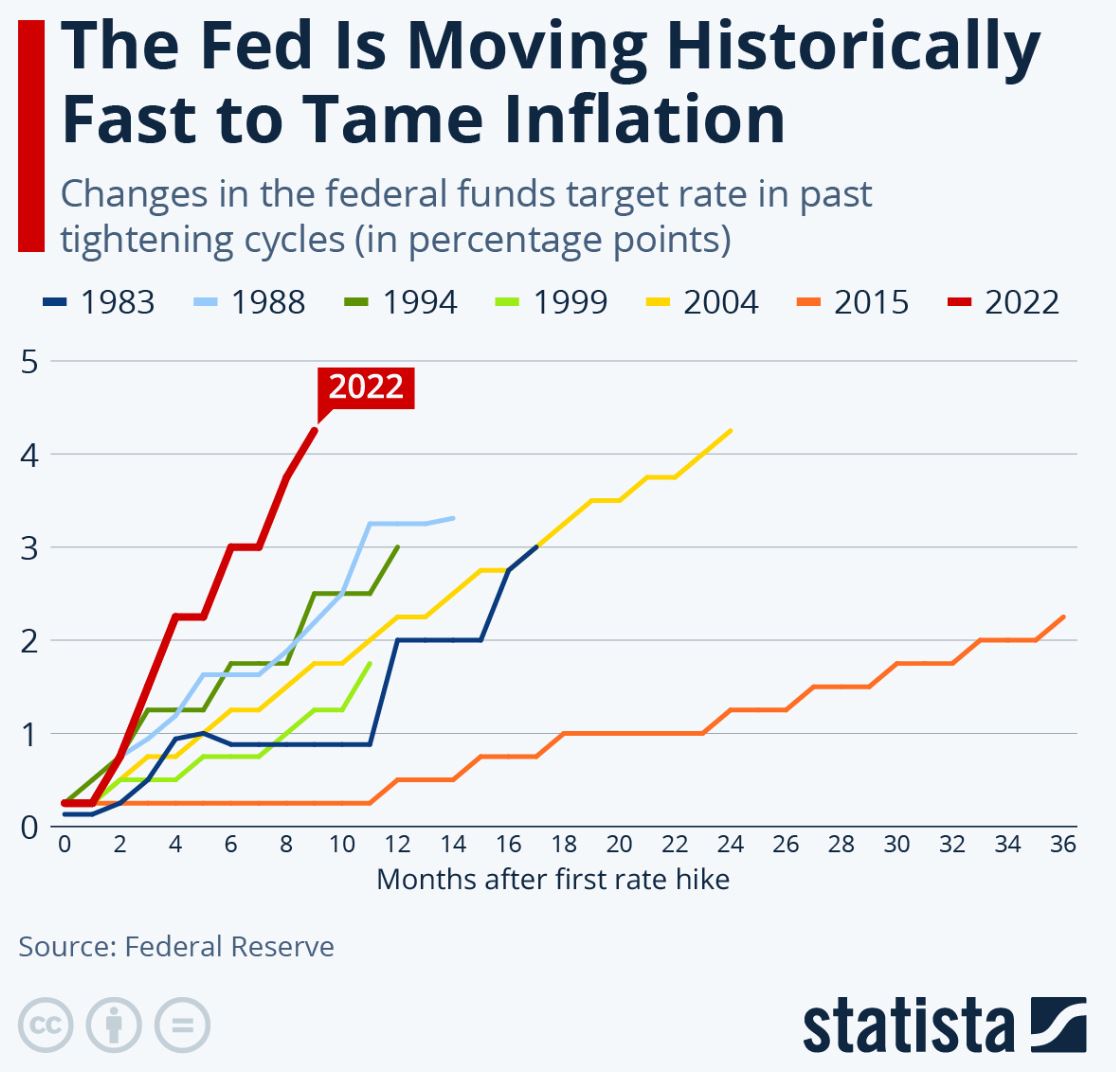

With all the above highlights/factors, it seems that the world is currently facing an "unprecedented" economic crisis, with countries across the globe experiencing high inflation and interest rate, market volatility, and economic instability. Other than high inflation and possible much longer and high interest rate, the other notable change would be the China’s attitude/ policy towards US that they will no longer “打不还手,骂不还口”, means they will start to “retaliate “ with “tit for tat” response, like latest China’s probe into US chip manufacturer Micron. This is definitely not help in alleviate the political tensions between these two super-power.

Hence, the current economic uncertainty highlights the need for more caution in setting our investment return targets.

While it may be tempting to pursue high returns in uncertain economic times, it is important to take into account the increased risk associated with the current economic climate. We should focus on long-term investment objectives and consider the potential impact of investment decisions based on our overall financial well-being and circumstances. Prepared for more "bumpy" years ahead and a more volatile market with a well-diversified portfolio across industries and counties.

1st Qtr 2023: Portfolio & Dividends Update

Before I proceed to update my portfolio, allow me to have a few highlights on my CPF-IS and interest received in 2022. I know I am a bit late to this so-called CPF interest update "party" as many members were happily updating their interest amount on the first day of Jan 2023. :D

2022 is an important milestone for us as far as CPF is concerned as our total CPF amount exceeded the $1 mil mark with an additional interest of $32,446.16 credited to our account and we also received $3497 of dividend paid from our CPF-IS account throughout the year.

We all know that CPF is a vital part of Singapore's social security system and has played a crucial role in ensuring that we have access to retirement, healthcare, and housing benefits. It has helped to provide financial security to members and has contributed to the need for sustainable retirement requirements.

But as I mentioned before, CPF is not a "super-hero" that would be able to tackle all our three main requirements i.e retirement/healthcare and housing. Sometimes, we need to make a "difficult" choice to meet the requirement for certain aspects, e.g I choose to spend less on housing in order to let my money roll and compound in our CPF account. If one chooses to wipe out his/ her CPF-OA for housing purposes, he/she may not have enough $$ left in the CPF account to let the magic of compounding effect grow the money, and at the end of the day is a matter of "choice". I did some RSTU ( Retirement-sum Top Up) into my SA account a few times when I still working and this is mainly to save tax and of course to enjoy a higher interest rate in my SA account. I also topped up my SRS twice before I stop working in 2016, also mainly for tax relief purposes.

I am not sure if it is wise to do the VC3A up to the max if you are still young as you may lose out on the flexibility to access the funds for emergencies and other unexpected expenses. There is another opportunity cost like missing out on investment opportunities that could potentially generate higher returns. Always remember that CPF is a "saving tool" not an investment per se, if you are still young and have a long investment horizon, I think you should learn how to build a diversified investment portfolio which most probably may out-perform the interest earned in CPF in the long-run, even with a diversified passive / index investing. Well, as I blogged before, I like to treat CPF as AAA bond and, we did some VC3A top-up last two years when interest rate was still very low. I mentioned in my blog that under this super low interest rate situation, doing VC3A to get 3+% interest ( for me is like investing in 3-4 years AAA bond ) was not bad at that time actually. But I have stop doing that since I can get close to 4% yield on 6 months T-Bill. 😀

Above are my returns in CPF-IS and SRS ( I only top-up twice in 2013/14) accounts since 2009 and 2013 which I am happy to see that it managed to beat the 2.5% of interest in the OA account.

I think if you are still in the wealth "accumulation " stage, building up your skills and human capital is more important and once your salary and contributions increase in tandem, with the compounding effect, you may see the amount in your CPF increase slowly, eventually may reach a sizeable amount, instead of doing the VC3A to the max every year when you are still young and missing out the other opportunities of getting higher returns. It is important to consider these factors and find a balance between maximizing your CPF contributions/top-ups and maintaining financial flexibility and security.

Portfolio Update :

STE Portfolio Rteurns (XIRR ) YTD : +6.5%

## My portfolio manage to out-perform most of the benchmark indexes except the S&P 500 as below:

As of April 2023, the world stock market returns have been relatively positive, with some ups and downs. Although there have been some uncertainties in the global economy, many stock markets have continued to perform well. However, there are still some concerns about the global economy, including rising inflation, geopolitical tensions, and the cost increase due to de-globalization. These factors could derail economic growth and impact future stock market returns.

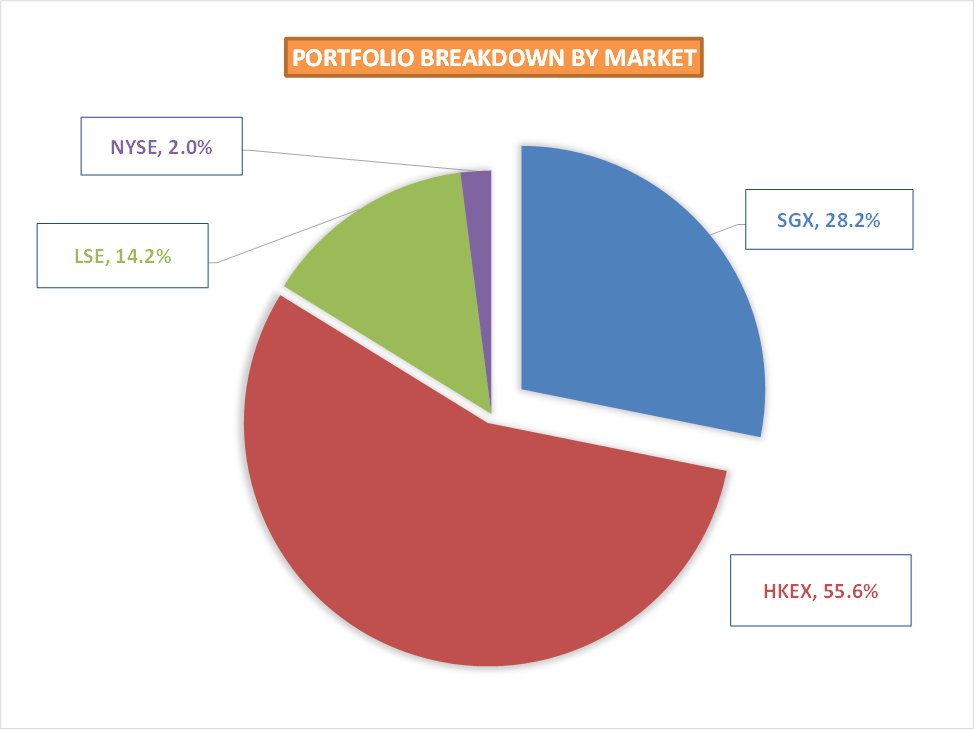

Since the last update, my portfolio didn't change much and I only added 1 new counter from HKEX ( CM Bank 3968). I also bought more and increased a bit of my holding on PingAn, CNOOC, Tracker Fund-2800, Keppel Corp, and CLCT.

STE Portfolio Bench-marking vs Other Major Indexes

You may notice that most of my returns are from early 2009-2017 (where I have explained in my previous blog post that I was really lucky to invest more during GFC) but my returns start to stagnant after 2019.

2019 was the year when I started to invest in the HKG market and the HKG market continues to face many challenges after challenges since then, from the Trade-War with the US to the China Tech crackdown and, the Covid-19 lockdown.

TTL Returns since 2019 -2023 ( include dividends )

STE: +4.3% average ( TTL:21.5%)

STI: +5.2% average ( TTL:+26.4%)

FEST-S REIT: +7.6% average (TTL:+37.93%)

HSI: -4.4% average (TTL:-21.8%)

FTSE100: +7.3% average (TTL:+36.44%)

S&P500:+11.8% average (TTL:59.1%)

For 5 years of returns since 2019, my portfolio underperformed all major indexes except HSI!

Yes, you are looking at the correct figure, despite collecting more than $255K of dividends from HKEX, my returns are still at -$26.6 K. But to be fair, the losses are mainly from Tech stocks and, if I exclude the Tech stocks, my return from HKEX would improve to +4.86% p.a instead of -0.66%

This is the challenge of investing and venturing into new markets and sectors. Well, I will continue to hold these tech stocks from HKEX and NYSE as I think tech will still be an important sector that we can't ignore in future growth prospects. With improving sentiment and policy changes recently, I'm now more positive about these stocks and will continue to hold.

As I highlighted earlier, I decided to add/DCA more value/dividends stocks since the last update instead of tech stocks. I guess this is mainly due to my more conservative "risk profile" as a retiree, I am more confident to add more value rather than growth stocks during the market downturn. I try to cap my Tech exposure in my portfolio at a certain % as I need dividend income to support my expenses and still have two daughters studying.

Portfolio Stocks Returns: YTD 2023

1st Qtr 2023 Dividend Update:

TTL Dividend in 1st Qtr 2023: $42,113.28

** The higher dividend received in 1st Qtr 2023 was mainly due to dividends in-specie from Keppel-Corp and Tenent ( $19,078.36)

** Without this, TTL dividend would be $23,034.92, almost same as last year or 0.4% higher.

As you may know, I have more than 50% of my portfolio value in HKEX and most of the company will have their dividend pay-out in the 2nd and 3rd Qtr after announcing their results in March, hence these are the total dividends by Qtr which has been announced and will be collected in 2nd and 3rd Qtr:

1st Qtr: $42,113.28

2nd Qtr: $35,594.17

3rd Qtr: $27,490.38

TTL (announced) Dividend for 2023: $105,197.83

This is the beauty of dividends/income investing, as by now you already know and can calculate your future cash flow in coming quarters, and have a sense of security that these incomes are pretty firm and secure unless something really bad happens to the company that they would have to suspend the payment.

Cheers ! till the next update.....

STE

P/S: World stock market index regression line:

Top 40 Holdings :

41-79 Holdings :

Thanks for your update and appreciate your insight on current economy situation.

ReplyDeleteThanks for your comments ! Much appreciated 🙏

ReplyDeleteThank you for your selfless sharing on your portfolio which has been an inspiration to me :)

ReplyDeletehttps://thesingaporemarket.blogspot.com/2023/03/on-target-for-6-figures-2023-semi.html

Hi Coven, thank you so much for the comments / compliment! Wow, I am impressed with your " 7 figures Portfolio " and congratulations for on target of having 6 figures of passive income in 2023! 👏👏💪Cheers

DeleteThanks for very informative and insightful sharing 😄

ReplyDeleteAbsolutely agree with you! Tech is definitely an important segment that shouldn't be overlooked. As an investor myself, I've also recognized the tremendous potential in the tech sector, which is why I've invested in a few tech stocks on the NYSE. The pace of technological advancements and innovation is remarkable, and it's reshaping various industries. Exciting times ahead for tech investors! Keep up the great insights!

ReplyDeleteHi KL,

DeleteThanks for the comments. Much appreciated!🙏