Crisis = Danger + Opportunity? (危机 = 危险+ 机会)

Market had rebounded strongly from last Friday’s dip after government

announced the new tightening measures (partial-Circuit Breaker) in response to

increasing local transmission cases to double digit figure which we never seen

for quite some time. There was also an increased in un-link cases among the

communities which I think is much riskier as many are shown as “asymptomatic “,

one of the reasons might be because those already have their Covid-19 vaccine

taken and will still being infected but with lesser severity.

Panic-selling after the announcement on last Friday causing the

STI index to drop by more than -90 points at one time, but the index has since rebounded

to the level higher than pre-announcement as of now.

STI Index ( 14 May -18 May 2021 )

|

| <Image source : YahooFinance.com> |

By judging from what's market reactions, it seems that we are

more confident this time around that we will be able to curb the spread of this

new variant with all these new measures being taken, since we already have

experience on previous CB and with more and more population getting vaccinated. Also, the strong and quick rebound partly due to ample liquidity available in the market , the fund just moving from asset to asset from time to time. Just look at money supply from countries all around the world , one may notice that "inflation" is the real /potential problem and definitely will be here eventually ,which been reflected in some of the commodity price like lumber/steel /iron-ore etc and housing price in some of the develop countries.

I can see the benefit

of increasing vaccination rate as it may reduce the severe case and less likely

to be hospitalized but I think it could be a “double edged sword “before hitting

the “herd immunity “rate as those infected with asymptomatic condition may “unintentionally

“become the super-spreader among the communities if leaving unchecked or

noticed. Hence the increase of mass and fast testing is particularly important and

the suggestion of “one dose “strategy could be another way to speed up the

total population to get their vaccine.

I know people are getting a bit frustrated with this new “tightening measures” like going “backward” in tackling the issue (we may notice this based on comments on MOH’s FB) and wondering why it happens since we are controlling quite well on our local transmission, with zero case for local transmission (some time in two weeks continuously), but with the increasing imported cases.

OK, by hindsight and uncle may be just a 事后孔明, but as an ordinary and not so educated citizen,

uncle been talking this to friends and neighbours that the “persistent” high

imported cases are quite alarming and worrying if not being tackled carefully

and diligently. (Well, I think most of us share the same view/feeling). Of

course, government will have their reasons and studies carefully in terms of pro

and cons by weighing the benefit (economically) of allowing more open border and

to allow such high imported cases to continue but I guess the question is how

effective the controlling measures to be taken to avoid the spreading virus from these infected (imported ) patients.

Ok, again by hindsight,

just look at below letter sent to The Strait Time on 15 April 2021. Can’t we

see, learn or pick up something from this letter?

Letter

of the week: Stricter Covid-19 measures needed for inbound passengers at

airport : Dated 15 April 2021 < source: The

Straits Times.com>

(# Writer mentioned his experience was 3 weeks ago from

the date of this letter, meaning that his observation was around early April

2021)

What the ?? below announcement was made after mini/partial-CB ☹

COVID-19:

Changi Airport to segregate flight arrivals from high-risk countries, regions

: Dated

15 May 2021 <source: Channelnewsasia.com>

What has done cannot be undone, no point finger-pointing on what

had happened and let us keep our fingers crossed and pray that things /

situation will become better from now onwards. Let us also play our part that practice

social distancing / less gathering and only going out for important activities.

Be responsible and wearing mask when going out (even slow walk at the park).

Appreciate

and big thanks to our frontline workers especially to those healthcare

workers who really scarify and putting themselves in the path of this “smart

and deadly” virus. They are the HERO that deserve to be recognized and commended

for their lifesaving efforts and personal sacrifices amid increased medical risk

in fending off this deadly virus.

|

| <Image credit : above.org> |

Crisis = Danger + Opportunity? (危机 = 危险+ 机会)

Well, last Friday’s market reaction is not a “crisis”, it was just a “dip” in the longer trend. Of course, we do not know what will happen

after the announcement as situation may turn worse or better. I didn’t do any “panic

sell” as I don’t think market will collapse like the one in Mar 2020 where we don’t

know what will happen next and the virus is still pretty much new and un-know

to us as compared to now that we are at least have a little bit experience on how

to deal with it and furthermore with vaccine in place. I also do not “buy the

dips” as I already have high exposure in equity and the valuation is not as

cheap as in March 2020. Of course, if you are a young and in wealth

accumulation stage, this “dip” might be a good opportunity for you to do the

DCA.

Warren Buffett

once said that it is wise for investors to be “fearful when others are greedy, and greedy when

others are fearful.”

Of course, easier said than done, how many of us will have

the guts to press the “buy” button when others are panic selling like no

tomorrow. We may have “price anchoring “bias that market may continue to

drop that DBS will reach $8+ or OCBC at $4+ to a level reached during previous

crisis in 2008/09 (GFC).

Buying during crisis is such a painful thing to do as the

day you bought it, market may tank again tomorrow, you really need to have a strong

heart to go through such volatility. Furthermore, we simply do not know when

the market will hit bottom, hence, is wise to spread out you are buying in tranche.

Have your own system on how to deploy your war-chest, e.g., split into 3, buying

when market drop by -10%/-20%/-30% or -0.5SD/-1SD/-2SD etc.

In the past 34 years, there were 3 times that STI dropped

till -2SD level, that was in 1997/98 (Asian Financial

Crisis) (-62.2%), 2008/09 (Global Financial Crisis / Sub-prime) (-60.8%) and the latest 2020 (Covid-19

Global Pandemic) (-38%). Another one which almost reach -2SD was

the 2000 Dot.com bubble (-52%).

To see if you are really “greedy when others are fearful”, maybe you should do

a quick check on your net flow from March – Oct 2020 (before the market

rebounded strongly in Nov 2020).

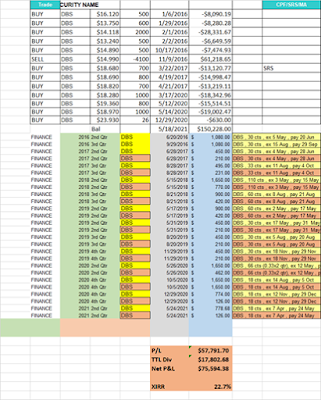

As for me, my total net flow was $379,882.97 during

this period of Mar-Oct 2020 and have deployed most of my war-chest back to the

market.

From my quarterly update, you may notice that OCBC is my

biggest holding now where I have bought additional 28,920 units with average

cost at around $8.65/unit during this period.

My luckiest bet was “BHP Group” which I bought in Apr

2020 without knowing that higher “inflation expectation “would push some of the

commodity price to sky high. It gave me a paper gain of $46K (+66%)

YTD. I have also ventured into KLSE market in June 2020 with new purchased of

counters like Maybank/Public Bank/LPI/ Panasonic M’sia / Carlsberg Brew)

and sitting with average +20% paper gain now.

This buying during “crisis “really help me to recoup most of my losses in 2020, especially my silly investing in Eagle Hospitality Trust and wrong betting on ARA Hospitality Trust (Updated here in my 2020 report card ).

Ok, paiseh ! uncle still talk about "recoup" the losses in 2020 but peoples are talking about making profit of 100-200% investing in Tech/ Growth stocks in 2020. STE still a newbie as far as tech stocks is concern and I promise will try to learn more , please bear with me... hahaha. :D

Well, that is all for this update, I shall share more on how

I would like to deploy my war-chest (dividend income) moving forward.

Stay healthy and stay tuned till next update :D

Cheers!!

STE

Quote of The Day :

“The stock

market is designed to transfer money from the active to the patient.” – Warren Buffett

Great sharing. Read your profile on your belief in Time, Timing, 天时, and inspired to share an article I written on 14 May 2021, on timing in different perspective.

ReplyDelete命运与投资 (14 May 2021)

Destiny & Investing

Investing Destiny has changed my investment life, added clarity, peacefulness and confidence to my investing plan and strategy.

Some of you have walked with me through the last 60 days and saw the beauty of Investing Destiny, how its concepts have reflected and happened in the real market.

Words and theory don't teach, experiences teach.

https://www.investingdestiny.com/274942635414may21.html

yipei

Hi Uncle STE

ReplyDeleteThanks for the sharing. Older uncle here learn a lot from you. :) Yeah I also deployed about the same amount as you last year.

Hi Uncle Henry,

ReplyDeleteGreat ! glad to know that you are buying during "crisis " as well ! Huat ah :D

Cheers !!

Hi STE,

ReplyDeleteThank you for your generous sharing. I have benefited from the regression file you sent me in early 2020 🙂 Sam 🙏🙏🙏

Hi PPP,

DeleteThanks for the comments and you are most welcome , glad to know that the file is useful !

:D Hope you have a great and "huat" year in 2021 !

Cheers !