Do We Need to Spend Few Thousand $$$ on Investment Courses ?

For me,

investing is a long learning journey and one need to read extensively and learn

from your own mistake not just sitting in the classroom for a few hours or days

, listening to some “experts “advice or

slides presentation on how to be a successful investor.

I don’t mind

if you need to spend few hundreds dollar just to get your “Mind-

Successful Investing: Nature? Or Nurture? ( click

here )

This is an

interesting article from Forbes questioning about the success of investing could

it is “ Nature or Nurture “? Can investment skill be learned and taught?

According to some studies ..” Evidence

Suggests A Little Of Both, But Mostly Nurture:

If

you ask most extremely successful investors they will tell you that investing

is a skill they developed and learned at some point along their journey.”

The KEY words here is .. skill the developed and learned ….along

their journey.

And also, they have pointed out 3 traits most successful investors have :

Learn From Your Mistakes:

One common trait

successful investors share is that they learn from their mistakes. Most

successful investors became successful after making - and here's the key -

learning, from all the classic beginner mistakes that nearly everyone makes

Be Patient:

Another successful

trait successful investors share is that they know profits are a function of

time and know the importance of being patient.

Respect Risk:

Another trait that

successful investors share is that they respect to risk. I have yet to see a very

successful investor achieve massive success for a sustained period of time

without respecting risk.

Here, I repeat, Successful Investing is through extensive

reading and learning from your own mistake in the different market cycle. Be realistic on your “Risk and Return”

expectation, a proper measurement of returns would be justifiable in the long

run and not just an extraordinary return in a short period of time.

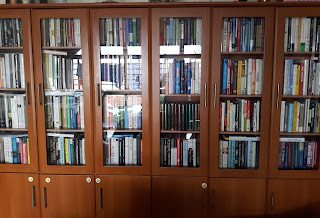

My Collection of Books and My Book List ( here

), if you want to know what am I reading to improve and sharpen my

investment skills.

You may find that quite a number of books in my Book

List were those in “ Behavioral Finance and Market Psychology “ as I always

emphasize that the stocks market is a combination of “ Science of Valuation and Art

of Market psychology “.

Further reading: My

Investment Strategy : 3 Ts 3 Ms ( part 3)

Ben Carlson from A Wealth of Common Sense is one of my favourites

blog which I will read most of the time as his “Common Sense “ approach in

highlighting some investment ideas is not common at all.

If you have no time to read all his blog post, here is the good

summary of his thoughts on investment :

36

Obvious Investment Truths

Well, for the reader who asked me the question earlier

, although I didn’t give you my direct answer of yes or no, I think from

this blog post, you get to know what I mean ….

Cheers !!

Quote Of The Day :

“Successful investing is more about behaviour

and temperament than IQ or education.” From Ben Carlson “ A Wealth Of Common Sense “

PS: How much will you be accumulating if you put the money (say $4888) into Index Fund which may give you a return of 8.8% p.a: compounding ( just an example ) in the next 25 years of the investment life cycle?

.

.

.

.

.

.

.

.

Well, no prizes for guessing it right !! $ 40,258

Back in the 1980s, Richard Dennis & Bill Eckhardt were debating over nature or nurture for traders. The turtles experiment showed that it was more nurture, but not everyone had the temperament or psychology for it.

ReplyDeletehttp://www.tradingblox.com/originalturtles/story.htm

Hi Spur,

DeleteYes, temperament and psychology play a very important role other than education and quantitative analysis,,,is really a tough learning throughout many market cycles...

Cheers ! 😀😀:-)

Read? Greatest Traders vs. Greatest Investors???

DeleteActually a few thousands really too much la....

ReplyDeleteIts not an MBE or whatever, where you can find a job with it. Can you put that in resume? Can't right.

Its a tip session la, and some know it.

Hi Sillyinvestor,

DeleteYah..very true. ..but still people trying to get something from these " expensive " courses. .😀😀

Cheers

What is NOT taught enough is the Mind part; and Money Management based on our OWN account size?

ReplyDeleteThe trainers don't know much about you - the Starfish? How to help you to survive when you are out of the water and on the beach under hot Sun?

Hi Uncle CW,

DeleteYah..that's nice ...later Starfish become "salted fish" when market go crazy with more than 50% down..😂😂

Cheers. .

STE,

ReplyDeleteI love the pic on your library ;)

Now that's what needed for mastery of our craft!

Unfortunately, those willing to pay thousands on an investment course do so precisely they don't want to go through the process of learning...

They want a 3 year degree course distilled into a single weekend workshop.

Degree mills anyone?

LOL!

Hi SMOL,

DeleteYah. .3 year degree course in one week workshop. .so must charge high premium mah..😀😀😀

Cheers. .

I'm sure about one thing: the Investment Course is a Great Investment ... for the ones running the course

ReplyDeleteHi kehyi,

DeleteSo we should invest in their company instead... since the ROI and margin will be high , LOL :-)

Cheers !!

Once the market realized lesser and lesser bei kambing coming forward. Look at 8I Holding tock price now

DeleteSTE,

ReplyDeleteYou have more than 250 books. If average book price is $30, then it invested $7.5K in knowledge.

Kudo to you!

Hi Ray,

DeleteYes..is good investment as knowledge is power and priceless!

😀😀cheers !!

STE,

ReplyDeleteYour library is huge and impressive. Perhaps switching to e-books will help to save more space, although you cannot impress guests to your house :)

I think any investment/trading course that cost >$1000 is too much, particularly when there are free resources like library books, internet forums and blogs like yours. A course that cost <$100 for a day's work is more reasonable. A fair payment for an honest day's work. For investors who want to DIY, making the time to read as many as books as you did is the right way to go to have a fair chance of beating the market. Spending >$1000 on courses, thinking they are short-cuts instead of spending lots of time and energy on reading about the different ways to make money from the markets is not likely to be fruitful. If Mr Market is so easy to beat, then most of us will be retiring in our early 40s. While I don't personally invest in passive ETFs or funds, I think they are the best option for those who have not the inclination nor the time to do DIY investing.

Branded investment training course fee has highly inflated over two decades from 988, 1,888, 2,888, 3,888, and now 4,888

DeleteHi hyom hyom,

DeleteThanks for the comments , yah , I have try to switch to e-book before , but still prefer to have the "touch and smell " of hard-copy ,, :-)

Yah, successful investing is not easy at all , not by just attending few investment courses , it need commitment and patience with knowledge in finance and psychology as well...

Yes, indeed , passive ETF might be another option for those wanted to do DIY but with no time to closely monitor the market,, but it also will need time to compound and riding through various market cycles..

Cheers !!

Hi Createwealth8888,

ReplyDeleteI didn't know branded investment training courses can charge until $4888 today. Meaningful success in investing hinges on size of capital. A great return >20% on a small portfolio (20k) is not going to make much of an impact given Singapore's high cost of living. Newbies need all the capital they can muster to get started in this difficult game of investing. There are gurus who give investment advice freely. Anyone can read Warren Buffett's shareholders' letters free of charge. Why pay $4888 to investment trainers when they can learn free of charge from the best (Warren Buffett)?

Here is a quote from the late Dr Leong, founder of ShareInvestor.com. He himself is an accomplished investor.

Finally, always remember that real investors make their money from the markets directly. If it is in their DNA to share, they will do so freely... and will never sell you a get-rich-quick investment course!

For those of us who make money directly from the markets, we know how difficult it is for the novice investor to start investing. The least we can do is to show you the ropes free of charge. We will never want to take any part of your savings just to show you the ropes. This money is needed by you to start off your investment journey. Hence, my conscience will certainly not allow me to take such money. I rather share freely, or not at all.

The best example of a real investor is of course, Warren Buffett.

http://pertama.freeforums.net/thread/77/real-investors#ixzz406iJZvsr