Few Important Mathematical Concept in Investing

Other than the famous “Rule of 72” which is well known by

most of the value investors, below are few more mathematical concepts which I think

is also rather important for anyone who is involving in stock investing.

Concept explained :

Rule of 72 ( by Investopedia )

The 'Rule of 72' is a simplified way to determine how long an investment will take to double, given a

fixed annual rate of interest. By dividing 72 by the annual rate of return, investors can get a rough

estimate of how many years it will take for the initial investment to duplicate

itself.

For

example, the rule of 72 states that $1 invested at 10% would take 7.2 years

((72/10) = 7.2) to turn into $2. In reality, a 10% investment will take 7.3

years to double ((1.10^7.3 = 2).

When

dealing with low rates of return, the Rule of 72 is fairly accurate. This chart

compares the numbers given by the rule of 72 and the actual number of years it

takes an investment to double.

Rate of Return

|

Rule of 72

|

Actual # of Years

|

Difference (#) of Years

|

2%

|

36.0

|

35

|

1.0

|

3%

|

24.0

|

23.45

|

0.6

|

5%

|

14.4

|

14.21

|

0.2

|

7%

|

10.3

|

10.24

|

0.0

|

9%

|

8.0

|

8.04

|

0.0

|

12%

|

6.0

|

6.12

|

0.1

|

25%

|

2.9

|

3.11

|

0.2

|

50%

|

1.4

|

1.71

|

0.3

|

72%

|

1.0

|

1.28

|

0.3

|

100%

|

0.7

|

1

|

0.3

|

Notice

that, although it gives a quick rough estimate, the rule of 72 gets less

precise as rates of return become higher. Therefore, when dealing with higher

rates, it's best to calculate the precise number of years algebraically by

means of the future value formula.

I loosely translate it to English in ()

1 1) 一支股票跌了一半之後,需要升一倍才重返原來價位。

( A stock which has dropped by 50% will require 100 % gain

eventually to return to the original price. )

2) 一支股票將會跌九成的話,你在它跌去八成時買入,你還將會損失一半。

( If a stock is expected to drop by -90%,

you bought in at -80%, you still will lose by half of your value.)

3) 每年12%回報,1年是1.12,10年後是三倍多,20年後近10倍回報。

( At 12% return p.a , the 1-year return is 1.12,

after 10 years will be more than 3 times, after 20 years will have almost 10

times return.)

4) 每次交易失去2%(交易成本?),10次後只剩下八成本金,20次後只餘下三份之二。

(Your transaction cost is 2% in every trade,

after 10 times of trading, you will left

will 80% of capital, after 20 times, will left will 2/3 of capital.)

5) 定止蝕位在10%,止蝕5次本金只剩下六成,止蝕十次只剩下三成多。

( Fixing your cut loss at 10%, 5 times cutting

loss will leave you with 60% of capital, cut loss of 10 times will only leave

30% of capital .)

6) 一次止賺10%,一次止蝕10%,出來的結果是本金的0.99,而不是打和,即少於1。

(One-time profit-taking of 10%, One-time cut loss of 10%, resulting in 0.99 times of capital, not balance up but with less than 1.)

7) 一次止賺30%,一次止蝕30%,出來的結果是本金的0.91。

( One time profit

taking off 30% follow by one time 30% cut loss, result with being remaining capital

of 91 % or 0.91 )

You may read the full blog post in below link : ( In Chinese )

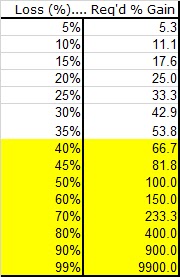

Another useful formula and table :

Percentage Recovery Formula

:

y = x/(1-x)

where y is the percentage gain required to break even and x

is the percentage lost?

So if you lost 80% (.80), the break-even recovery gain is

.8/(1-.8)=4, or 400%.

The worst performance stock ( O&G sectors ) in my portfolio is sitting with a paper loss of

around -30%, which will require more

than 42% of return in future.

How about you? What are the worst counter and percentage of

loss in your portfolio and the required return to break even?

Cheers!

Quote Of The Day :

Hi STE,

ReplyDeleteQuote " 一支股票跌了一半之後,需要升一倍才重返原來價位。

( A stock which has dropped by 50% will require 100 % gain eventually to return to original price. )"

Unquote.

Base on relative math, it is correct.

However, if we base on absolute term, then it is not right. For example, if we lose $5K base on $10K capital, we lost 50%. To gain back to $10K, we need to recover 50%. In absolute term, if we gain back $5K, then we breakeven.

Correction ...To gain back to $10K, we need to recover 100% [instead of 50%]

DeleteHi Ray,

ReplyDeleteYah ! U got it ... this is base on relative term .. in absolute , $5K lost need $5k recovery / return ... that's what the carton tell us " MATH = Mental Abuse To Human " ,,, hahaha . depend on where and how we interpret it .. :)

Cheers !

Hi STE,

ReplyDeleteMy worst counter also from O&G and it's from US.. so far it's at -80% so I already treated it as "gone case" account lol

Hi Richard ,

DeleteWow! Base on above table, you need 400 % to break even from current price ..😧 well, in investing, we make mistakes and learn from time to time. ..交学费。

Cheers!

Hi Richard ,

DeleteWow! Base on above table, you need 400 % to break even from current price ..😧 well, in investing, we make mistakes and learn from time to time. ..交学费。

Cheers!

Yup! That's why I already treated it as "gone"... :-)

Delete