The Importance of “Human Capital” in Financial Planning

For a company or organization, “Human Capital” is a measure of the

skills, education, capacity and attributes of labour which influence their

productive capacity and earning potential.

According to the OECD, human capital

is defined as:

“The knowledge, skills, competencies

and other attributes embodied in individuals or groups of individuals acquired

during their life and used to produce goods, services or ideas in the market

circumstances”.

The human capital of the economy – The aggregate human capital of an economy, which will be determined by national

educational standards

Gary

Becker, a renowned behavioural economist defined “Human Capital” (1964) as “determined by education, training, medical treatment, and is

effectively a means of production. Increased human capital explains the

differential of income for graduates. Human capital is also important for

influencing rates of economic growth.”

Human Capital from Individual's Perspective :

But as for an individual, human capital is the economic

value of our ability and skills to earn an income and it is an important part of our

big-picture in financial and retirement planning.

In most of the

financial planning, we often overlook the importance of our “human capital”

and paid too much attention to chasing or trying to achieve the highest ROI of

our financial asset.

I think during the early stage of “wealth accumulation “, one should focus or at least give more

attention to improve our earning power to achieve an “above average “ income

level as compare to our peers.

We do understand

the importance of “ saving and investing

“ but as the most simple and yet important equation shown :

Saving = Income- expenses

Ultimately, to

increase our saving rate is not just by cutting our unnecessary expenses ( or

cutting down our spending on Starbucks –just kidding ), one should also look

at the other side of the equation of “income “ through the potential of our

human capital.

For a typical

individual in their 20’s or 30s, you may have tremendous potential in

human capital but generally little financial capital or savings.

The

relationship between our human and financial capital generally reverses as we

reach our 50’s. If we have earned, saved and invest successfully, our financial

capital should increase as our earning power from human capital (income)

decrease.

As such, “Human capital” is critical when

considering our financial future as well as ways to reduce risk and maintain

financial stability throughout the course of a lifetime.

As we age, our

human capital is diminished. We have fewer working years ahead, and health (of

ourselves or our loved one) can play an important factor in our ability to keep

working, by that time, our income from “financial

asset “ should play a bigger role and take over from our human capital.

Bench-marking your salary :

How about

doing a bench-marking of your salary with other cohorts at your age group.

Below taken from

“www.salary.sg/2015/

So, simply divide your total

gross annual income (including bonus) by 12, enter the result below and compare

away:

Within the "40 - 44" age

group, your gross monthly pay of $9,100

places you at the 75.5th percentile among males.

You are in the top 24.5% of your cohort.

Gross Monthly Income:

Compare with age group:

Compare with gender:

© Salary.sg 2015

places you at the 75.5th percentile among males.

You are in the top 24.5% of your cohort.

Gross Monthly Income:

Compare with age group:

Compare with gender:

© Salary.sg 2015

With this, STE felt he is very lucky and happy to see that

his last draw salary level in 2014 is in top 24.5% of his cohort. With simple

lifestyle and be able to save more from his income and invest (more during a crisis ), he is able to live on his “financial “ income since 2015.

<I am not so sure how accurate is the result, but anyway

, I am happy with it … hahaha 😉.. kind of informal disclaimer >

I am very sure that much of my investment capital came from my

“human capital “ and couple with my simple & frugal lifestyle. My

advice to the younger generation’s investors is not to overlook the importance of

our “human capital “ in chasing for higher ROI of our financial

investment.

Cheers !!

Quote Of The Day:

"In the long run, your

human capital is your main base of competition. Your leading indicator of where

you're going to be 20 years from now is how well you're doing in your education system. "Bill Gates

Below quoted from Investopedia on how should we allocate our

financial capital (portfolio ) base on our human capital.

Over your lifetime, your human and financial capital should go in opposite directions. As you age, you have the opportunity to use your human capital to increase your financial capital. It is an "opportunity" because financial capital is not a given; it is earned through wages, savings and smart investment decisions. (For more on this, see Young Investors: What Are You Waiting For?)

During your working career, the risk characteristics of your human capital should affect how you allocate your financial capital. Factors like job stability, income volatility and the industry sector in which you work should all be considered when selecting an asset allocation for your financial capital. Below are two examples of how the risk characteristics of your human capital can affect the asset allocation of your financial capital.

What do you think? Should we take on a more risky asset if we have a more

stable job and higher income level?

Appendix :

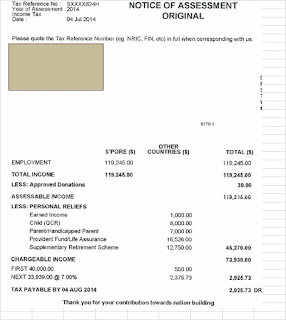

From $115K (YOA 2014)

, $105K (YOA 2015) to Zero in (YOA 2016) !

STE’s household income suddenly dropped by more than $100 K

from 2015 onward and for YOA 2017 will still be zero in my next submission.

Although this is a really big dropped from an absolute value

point of view, but maintaining a simple lifestyle allows us to survive with income

from a financial asset for the past 2.5 years. Avoiding “Lifestyle Inflation “ is also the

key to achieve F.I.R.E.

Well, some may think that lifestyle is a choice, one may choose

to continue upgrading his house, buying a bigger car and more luxury items etc…

Yes! I choose to exchange all that with “TIME “,, more time for me to spend

with my family, more time to do exercise, more to time read, more time to do

gardening, more time to blog and

recently more time to catch Pokemon! hahaha 😊

---- EOM -----

The article provide me the very interesting detail about particular topic, i am really amazed while reading this.

ReplyDeleteStocks to Buy Today

Tax planning is the art of implementing strategies that help you reach your financial goals, be more productive and helping you pay taxes on time. this article is interesting and informative.

ReplyDeleteThey did, however, experience (a) significantly greater fluctuations in marital satisfaction across assessments Financial Advisor Sydney

ReplyDeleteNice Blog, Thanks For Sharing information. if you Find Professional Financial Planning and other resources to help with retirement, investing, credit repair & more. From Carnick & Kubik https://carnick.com/services/

ReplyDeleteThe biggest benefit of having a business mentor is having someone you can ask questions and get best business advice. this is even more important to prevent financial instabilities. Check out Hghyork.co.uk as they have over 75 years’ experience in helping small, medium sized business and all.

ReplyDeleteThe blog was absolutely fantastic, Lot of information is helpful in some or the other way. Keep updating the blog, looking forward for more content…. Great job, keep it up.

ReplyDeleteFinancial planning

Even under employment, the income varies from 115k to 105k between the 2 years. Like stock market

ReplyDeleteI came across this link on investment funds, hope can provide more insights.

ReplyDeleteinvestment funds

Came here from seedly cheers good advise hehe

ReplyDelete